This Week in Cryptocurrency – February 9th, 2018

The Grass is Always Greener on the Other Side of a Dip

Calling it a dip doesn’t really do it justice. Even calling what we’ve experienced over the last month a correction seems to be in bad humor. How else do we justify crypto’s overall market cap going from $834bln at its peak in January to $282bln at its lowest point? By holding on with iron hands, that’s how.

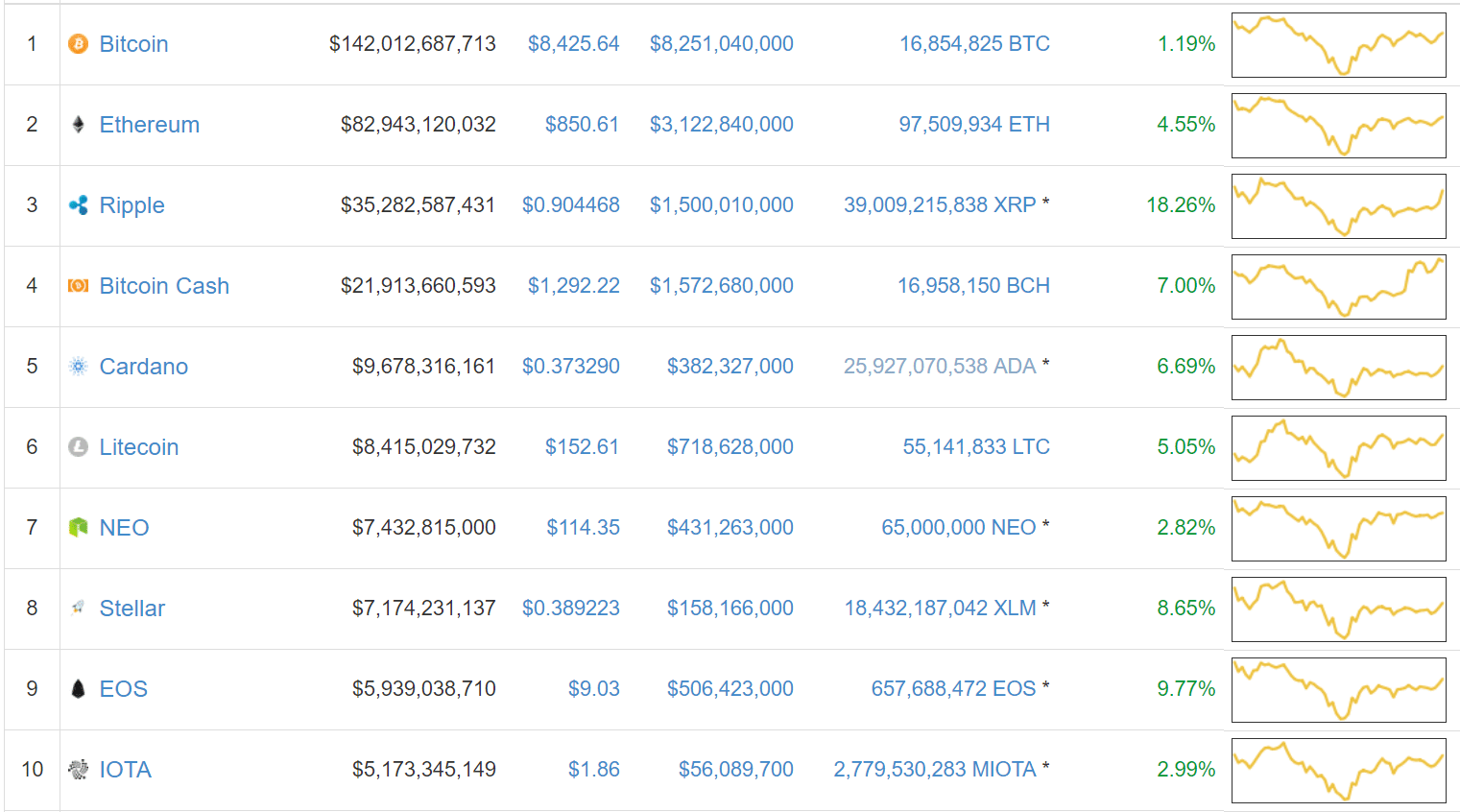

Now, we don’t know if it’s over yet, no matter how much we’re praying for the worst to be behind us. That said, the market is looking healthier than it has in a hot minute, and a top 10 smiling with green is something to be thankful for.

Bitcoin: Bitcoin has seen better days, that’s for sure, but all things considered, it’s doing pretty well. Well, technically it’s still down 2% from this time last week. But I think we can all agree that $8,400 is a lot better than the $6,000 rock bottom Bitcoin hit earlier in the week during the sell-off.

Ethereum: It looks like the marketcap’s runner up is in the exact same boat as Bitcoin. Ethereum is also down 2% from its starting point last Friday, currently sitting with a price of $854.

Ripple: Ripple breaks the mold Bitcoin/Ethereum set, though, as it is currently up 6% from this time last week. This is largely the result of some upwards price action last night that puled it up to $0.90.

Honorable Mentions: No honorable mentions this week, as no coin has done much worth mentioning (except E-coin, which is reloading for its second pump-n-dump of the week, up 1,855% in 24/hrs). No, we don’t have any legit honorable mentions, but rather, an honorable coincidence. As u/steelflight84 pointed out on r/cryptocurrency earlier this week, Bitcoin, Ethereum, and Ripple followed closely at each other’s heels during this week’s downwards race. So closely, in fact, that their prices mirrored each other by powers of 10.

Domestic News:

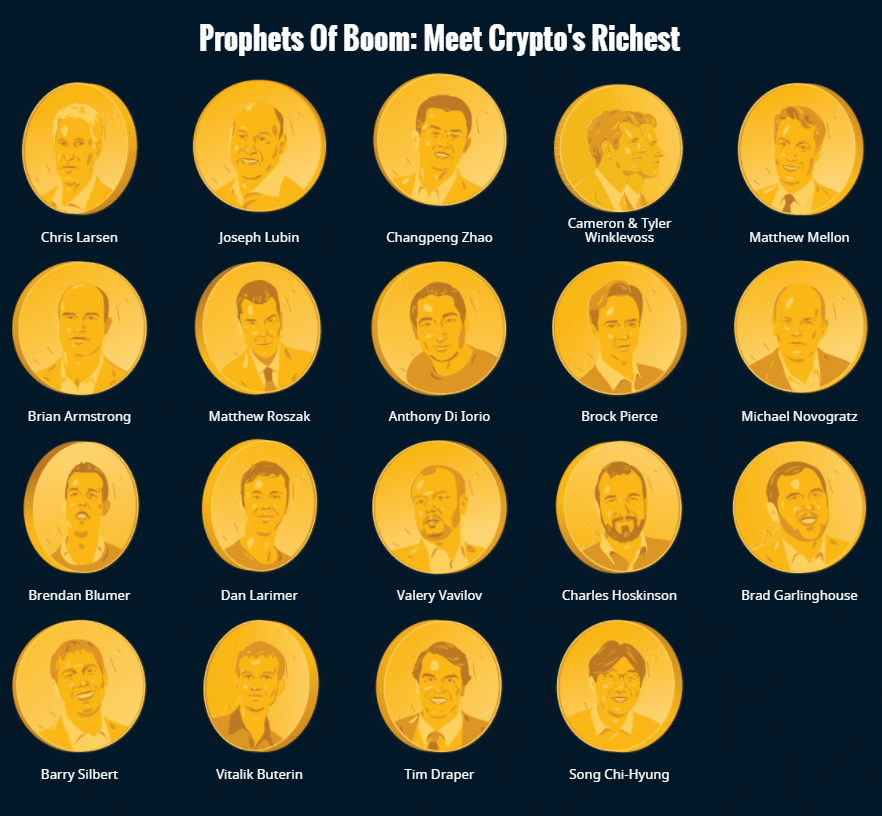

Forbes Gives Enthusiasts the Chance to Stalk Their Favorite Crypto Fat Cats: So stalk might be a strong word. Regardless, Forbes has released the first ever “Richest People in Cryptocurrency,” the digital economy equivalent of of the “World’s Billionaire List.” Topping the list include such figures as Ripple’s former CEO Chris Larsen and Binance founder Changpeng Zhao.

SEC/CFTC Senate Testimony Gives Crypto Hope (and a New Mascot): Jay Clayton and Chris Giancarlo made the case for regulating cryptocurrencies before the Senate on Tuesday. The meeting ended on a positive note, as legislators seemed open to the courses of action both the SEC/CFTC heads suggested. This gave investors and enthusiasts alike a glint of optimism for the future of the space in a time when the market’s crash was leaving many in despair. Giancarlo, who even told senators about the wonders of HODLing, left the meeting looking somewhat like a mascot for the crypto-sphere, and community members thanked him for his cheerleading by increasing his Twitter followers from 5k to 28.5k in under 48 hours.

Bittrex Turns Up the Heat on Coinbase, Looks to Add USD Deposits: First Robinhood announced that it would open cryptocurrency trading, and now Bittrex has announced that it will integrate USD deposits, while also opening up new accounts to welcome fresh users. Should Coinbase be worried? Like Bitcoin, it has first mover advantage, but it’s starting to see some competition enter the fiat-to-crypto marketplace.

Once Again, Goldman Sachs Says Most Coins Will Soon Be Worthless: Head of Global Investment Research Steve Strongin isn’t saying all coins won’t make it in the long run, but he is saying that most digital assets in their current form are worthless. In a “few-winners-take-most” market, blockchain technology will survive while “the currencies that don’t survive will most likely trade to zero.”

Credit Cards Companies Try to Fight the Rise of Crypto with Purchase Bans: Big banks like Bank of America and J.P. Morgan are starting to block purchases from known cryptocurrency exchanges like Coinbase. While the J.P. Morgan’s spokesperson Mary Jane Rogers says that the risk associated with cryptocurrencies is too high right now, it makes us wonder if the ban is an attempt to combat the success and rise of its competition.

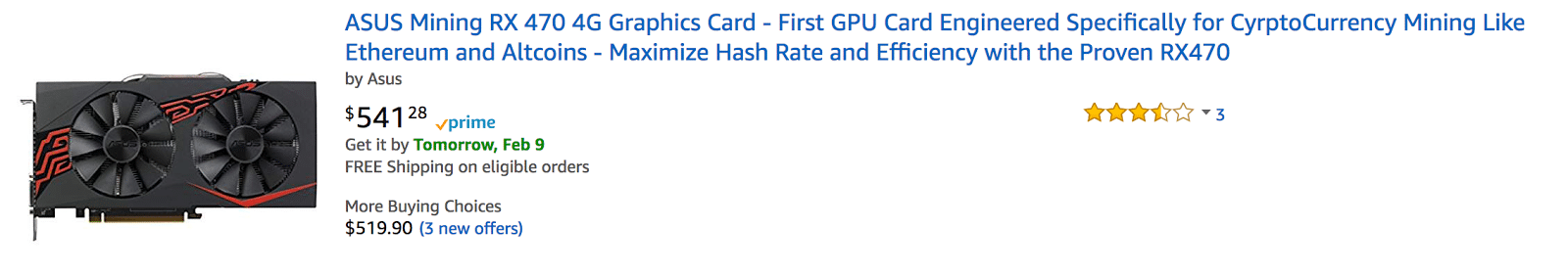

You Can Now Buy GPU’s For Crypto Mining on Amazon: If you were wondering where to purchase your first mining rig, look no further…Amazon is now offering miners the ability to score their very own GPU through third-party vendor sales. If you’re looking for a bargain, you can even buy a 6-pack of cold-hard GPU’s (that is, until they overheat). Prices for these tools have skyrocketed in the past three months, moving from the low $200s to nearly triple this price.

Ohio Teen Becomes Millionaire After Purchasing Crypto With Entire Life Savings: “I thought: ‘Wow, I just made a 10% return in a day. That’s crazy,'” said 18-year-old Eddy Zillan in an interview with Business Insider. Zillan started purchasing crypto at the young age of 15, 3 years beneath the required age to open a Coinbase account. But that didnt stop this opportune crpyto kid from joining in on the action, who now charges up to $250 an hour for his advising services.

California Crypto Enthusiasts Find New-Found Freedom in Puerto Rico: Living in a building they named “Sol”, a bunch of Californians moved to the Caribbean island not for its beauty, but to avoid capital gains taxes and federal taxes. Their goal is to establish a “cryptotopia” in the heart of the territory’s capital, San Juan, and they’re even saying that the government is allowing them to set up a cryptocurrency bank. Founder of Halsey Minor says while the hurricanes that wrecked Puerto Rico were awful, the low property costs and companies moving their headquarters to Puerto Rico is a “godsend” in the long-term.

What’s New at CoinCentral?

Behind the Scenes of Cryptocurrency Exchanges: Ever wanted to know more about of the secrets and strategies utilized by the world’s leading exchanges? Here, we highlight some of the insights gained at the 2018 Blockchain Connect Conference in San Francisco.

Off to the Races: The competition for the most popular decentralized exchange is underway, and we’ve compiled a list of the more popular DEXs out there so you can take your pick of the litter.

KuCoin Exchange Review: How does the KuCoin trading platform stack up against competitors? We’ll tell you.

NEO’s New Vision: The Moonshot: NEO DevCon brought together blockchain enthusiasts, developers, investors, and entrepreneurs from all around the world into an intimate environment teaming with information and enthusiasm. Come join us in learning more about what the NEO team envisions and where its going in the future.

What is Status (SNT)?: Want to know more about this mobile client reimagining the social network? Search no further.

What is Zilliqa?: This guide takes an in-depth look at a blockchain with a high-scalability solution.

What is MaidSafeCoin?: While the SAFE network is still in its infancy, its clear the many possible benefits that can occur through the project’s mission. Learn more about this game changing technology in this article.

Cryptocurrency Industry Spotlight: Tim Draper: A long-time advocate of Bitcoin and blockchain technology, Draper has attracted significant attention to himself and his activity in the cryptocurrency world. Find out more about this venture capitalist and prominent figure in the blockchain world in this industry spotlight. Draper University also launched a Blockchain Intensive course tailored around Draper’s and his network’s insights.

Growing the Blockchain Community was a Big Topic at NEO DevCon: In this article, we take a look at some of the biggest themes coming out of NEO’s DevCon in terms of growing the blockchain community.

[thrive_leads id=’5219′]

What is Power Ledger (POWR)?: Imagine a world without reliance on big utility companies or foreign resources for all the energy needed to run your life. Hello future, meet Power Ledger.

Blockchain Connect 2018 Recap: On January 26, the CoinCentral team had the pleasure of attending the Blockchain Connect conference in San Francisco. Although impossible to include all of the amazing conference happenings, in this recap we highlight some of the events that really stood out.

What are KuCoin Shares (KCS)?: What if holding 1 coin earned you 200+ different coins every day? Welcome to KuCoin, Binance’s fiercest competitor.

What is Loopring?: It’s not an exchange, but it is made for exchanging. See this guide to learn more about the protocols that make Loopring truly a one-of-a-kind platform for decentralized exchanging.

How to Make a Shitcoin: From quick cash grabs to flat out scams, it seems like everyone is taking advantage of the booming, yet unregulated, cryptocurrency market these days. So, why shouldn’t you? (disclaimer: you definitely shouldn’t).

SEC and CFTC Make Case for Crypto Regulations Before Senate: The buck actually starts here as they US government calls for regulations. Is it a step in the right direction?

Min Kim Speaks on ICON’s Commitment to Education, Adoption: At this year’s first annual Blockchain Connect, a few of us from Coin Central sat down for an interview with Min Kim, a member of ICON’s Foundation Council and the Chief Strategy Officer at DAYLI Financial Group.

Asic, GPU, and CPU Mining: Before making your next trade or investment, consider the ramifications of whether your coin uses ASIC, GPU, and CPU mining–if it’s Proof of Work, that is. But first, you’ll need to learn the differences among these mining processes.

What is WanChain?: Find out why 2018 is shaping up to be a big year for the WanChain project.

What is Electroneum?: Even though Electroneum is named after the electron, it’s hard to be negative about its future. In this beginner’s guide, we explore the inner workings of Electorneum, set to shake up the blockchain industry in no time.

[thrive_leads id=’3527′]

Cryptocurrency News from Around the World

Bitcoin No Longer the Darkweb Favorite: If you’re looking to pay for illicit services on the internet, you may want to look at Bitcoin’s little brother for help. Litecoin has won the favor of the internet’s grimy underbelly. According to a report by Recorded Future, Litecoin is accepted by 30% of Darkweb vendors, with DASH and Bitcoin Cash coming in at second and third, respectively.

UNICEF Wants You to Mine Ethereum for Syrian Children: According to Reuters, more than 500 people have joined the “Game Changers” Initiative to support children of the war-torn country of Syria. In a statement, UNICEF said “through the use of mining we create an opportunity for those who cannot give or have never had the opportunity to do so.” The project has already raised more than 1,500 euros since its launch on February 2nd.

China Bans Foreign Exchange Platforms in Efforts to Stop Trading: China is attempting to put an ultimate end to ICO’s and crypto trading, as stated in an article by the Financial Times (affiliated to the People’s Bank of China). Like American credit card companies trying to stop crypto purchases due to “financial risks,” China believes digital assets are too risky to continue in their current form. Despite all the Chinese government’s actions in mitigating the risks, its citizens are finding ways to continue trading.

Unlike China, Singapore Welcomes Cryptocurrency… “For Now”: On Monday, Deputy Prime Minister of Singapore Tharman Shanmugaratnam stated “for now, the nature and scale of cryptocurrency trading in Singapore does not pose risks to the safety and integrity of our financial system.” The relaxed views coming from Singapore’s government follow Japan’s lenient attitudes towards blockchain technology, with both countries seeing the great potential of cryptocurrency.

Not a Hack: Binance Halts Trades for Maintenance: One of the world’s most popular cryptocurrency exchanges, Binance, recently suspended withdrawals and trading. According to Changpeng Zhao, Binance’s CEO, there was an issue with the exchange’s servers that left data “out of sync,” but he assured users that all data is safe. Services went down on the 7th and are expected to resume on the 9th.

In Other News, Porn Is Now Being Used to Mine Cryptocurrencies: Noticing that your computer is as hot and heavy as you after indulging in some online fantasies? If yes, your porn habits could be making someone else money. A recent study by the Chinese security firm 360 Netlab shows that 49% of all browser mining comes from porn websites. These sites run mining scripts that use visitors’ computers to mine various currencies while they sate their carnal appetites.

Regulations Not on European Central Bank’s Agenda: While the United States has seemingly opened up its doors to regulatory discussions, the European Central Bank isn’t ready to give the topic a knock. “We scrutinize the issue in a regulatory perspective, we are ready to do something if it was needed, but so far it’s not exactly very high on our to-do list,” ECB’s Chair of the Supervisory Board Daniele Nou told CNBC in a recent interview.

For Other Banks, a Move to Ban Crypto Purchases on Credit: The markets were taking a hit, and banks in the UK follow in the footsteps of their brothers across the pond to mitigate risks. Loyds Banking Group Plc and Virgin Money have blocked cryptocurrency purchases on their credit cards. At the height of crypto’s run-up at the end of the year, credit card purchases became increasingly common, and the move looks to protect customers from plunging into debt as the market went into free-fall.

North Korea Likely Behind Coincheck Hack, South Korean Officials Say: Japanese exchange Coincheck was hacked two weeks ago, leaving $530mln in cryptocurrency stolen. South Korea’s National Intelligence Service believes that North Korea could have been behind the attack. Unfortunately, this isn’t too surprising, as North Korea is also suspected to have been behind a series of Bithumb and Youbit attacks that occurred last year.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.