- How it Works

- Order Rings and Order Sharing

- Loopring’s Team and What’s to Come

- Competition

- Trading History

- Where to Buy, Where to Store

- Final Thoughts

What is Loopring?

Loopring is a decentralized exchange protocol and an “automated execution system” built on Ethereum that will allow its users to trade assets across exchanges. It isn’t a decentralized exchange. Rather, it facilitates decentralized exchanging through ring-sharing and order matching.

Lot of new buzz words there to hone in on, but we’ll cut out the buzz a bit later. For right now, the important thing to understand is that Loopring will pool all orders sent to its network and fill these orders through the order books of multiple exchanges. Decentralized and centralized exchanges alike will be able to implement Loopring, giving the exchanges access to cross blockchain and cross exchange liquidity and giving investors access to the best prices available on the broader market. Moreover, Loopring is blockchain agnostic, meaning that any platform that uses smart contracts (e.g., NEO, Ethereum, Qtum) can integrate with Loopring.

Now that we’ve gone over the basics, let’s build on this for a more detailed understanding.

How it Works

When using Loopring, traders never have to deposit funds into an exchange to begin trading. Even with decentralized exchanges like Ether Delta, IDex, or Bitshares, you’d have to deposit your funds onto the platform, usually via an Ethereum smart contract. But with Loopring, funds always remain in user wallets and are never locked by orders. This gives you complete autonomy over your funds while trading, allowing you to cancel, trim, or increase an order before it is executed. You could even move funds from your wallet entirely after placing an order, though this would affect your final order, as the protocol’s ring miners would be alerted to the wallet’s balance before matching orders.

Speaking of ring miners, let’s go over the anatomy of an exchange on Loopring’s protocol.

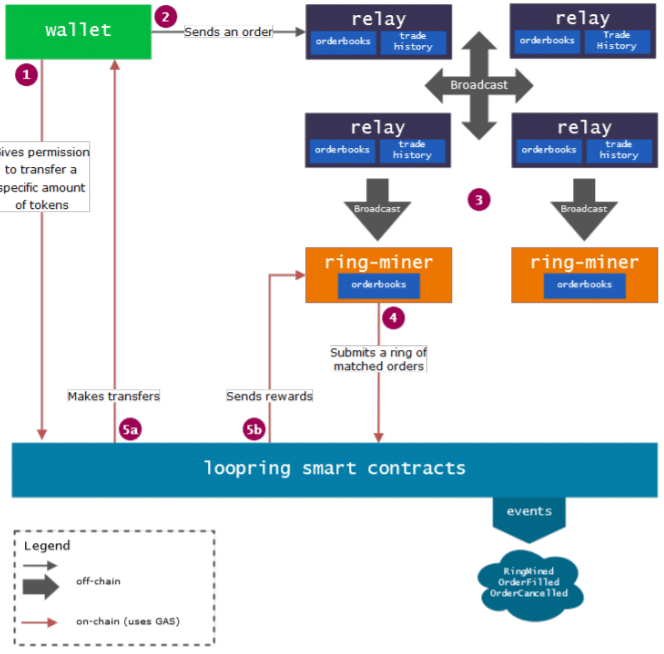

Placing an Order

When you’re ready to make a trade, you’d submit an order through the loopring.io wallet, signing off on it with your private key. This order would then be sent to both smart contracts on the Loopring network and a series of off-chain relay nodes. The smart contracts ensure that, when your order is matched, the funds in your wallet will be exchanged for the traded coins, and the off-chain relays are responsible for maintaining an order book and broadcasting these orders to ring-miners.

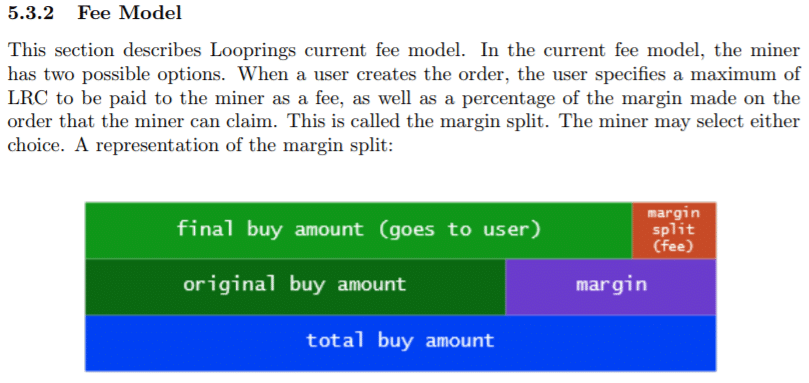

Ring Miners

Ring-miners make sure that orders can be filled (or partially filled) through order rings until the desired trades are completed for all parties involved. In compensation for this service, ring miners can receive a fee in LRC (Loopring’s token) or a split-margin on the final purchasing amount of an order. For example, if you wanted to trade 1 ETH for 10 NEO but the ring miner found a trade for 11 NEO, he could split part of this margin with you, or he could choose to take the LRC fee specified when the order was sent. This ensures that miners are paid fairly for finding the best exchange rates for traders, and it allows traders to get the biggest bang for their buck–theoretically, this would also reduce arbitrage opportunities, as the best trading value is offered inherently through the protocol.

Settling a Trade

Once an order ring is completed, Loopring’s smart contracts evaluate the orders to make sure that they can be fulfilled. If everything checks out, the smart contracts transfer coins to their respective recipients. This process is atomic and takes place wallet-to-wallet.

Order Rings and Order Sharing

Both of these functions separate Loopring from other decentralized exchange platforms. An order ring allows for ring-matching, a process by which a series of trades are strung together to fulfill each other’s orders. In addition, if an order cannot be completed with a single trade, order sharing allows this order to be split into partial orders until the original order amount is completely filled.

Some help from our hypothetical volunteers may better demonstrate these practices in action. Molly, Angela, and Carl all want to execute a trade on the Loopring network. Molly wants to trade 2 OMG for 10 ARK, Angela wants to trade 21 EOS for 1.5 OMG, and Carl wants to trade 20 ARK for 40 EOS. Through ring-matching, ring miners would form these dislocated orders into a single order ring, wherein Molly would trade her OMG to Angela, Angela would trade her EOS to Carl, and Carl would trade his ARK to Molly. After this ring order is approved through Loopring’s smart contracts, everyone receives their sought-after coins and everyone is happy.

Only one problem: not everyone’s order has been completed. Molly received her 10 ARK but still has 0.5 OMG left over and Carl still needs to trade 10 ARK for 19 EOS–only Angela walked away with her order completely filled. Thanks to Loopring’s order sharing, though, this wouldn’t be an issue. The leftovers would then be processed into another order ring until each partial order added up to a completed order.

Loopring’s Team and What’s to Come

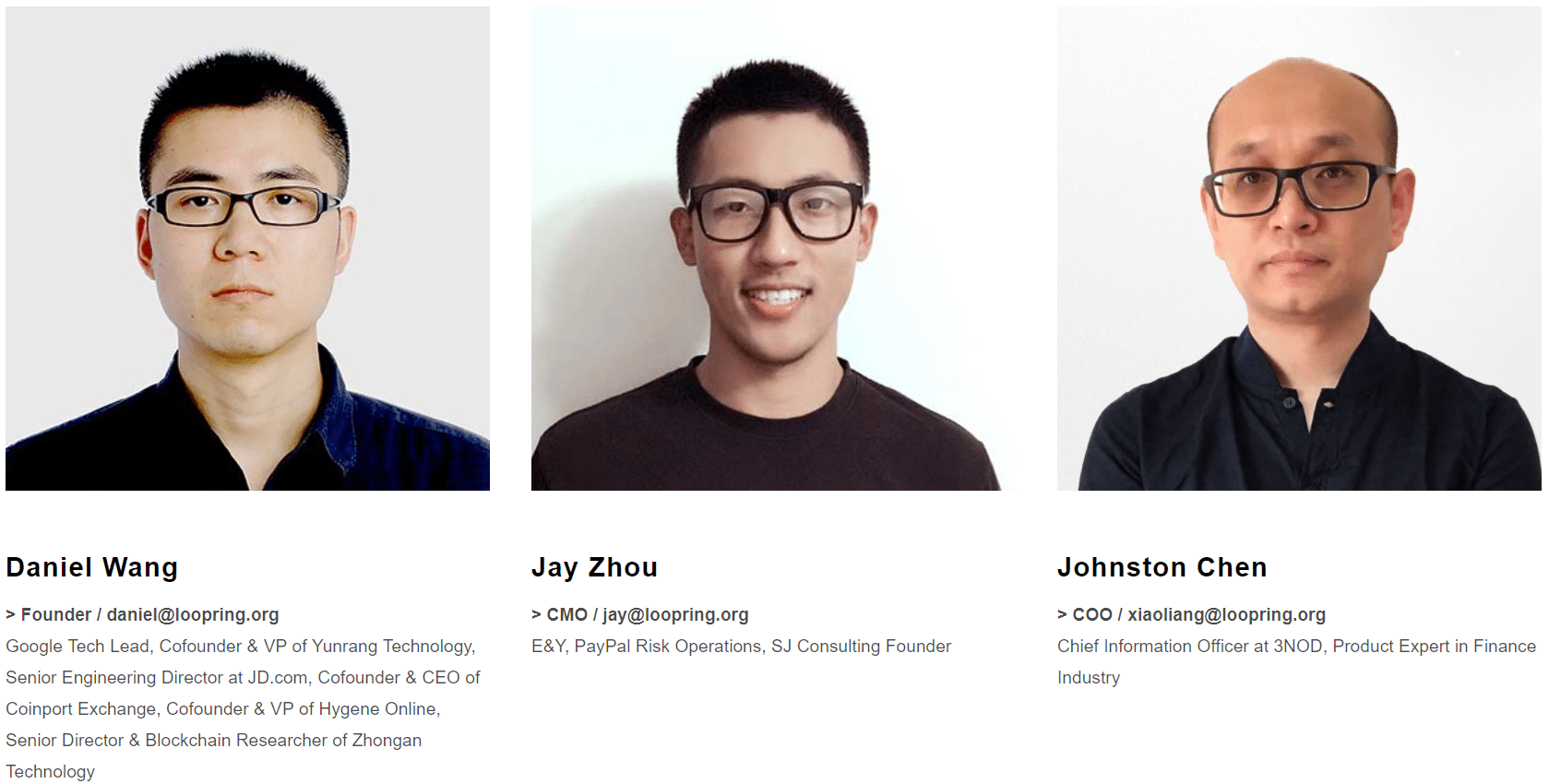

Serving as its head, Loopring founder Daniel Wang used to run a centralized exchange called Coin Port back in 2014. “At that time,” he told Coin Central in an interview, “[I was] trying to solve the problems of centralized exchanges, and then I realized that it’s not possible. Those problems are inherent to the centralized exchange model.” Thus, he began conceptualizing what would become Loopring. In the past, he’s also held a position as a Google Tech Lead and was a co-founder and VP of Yunrang Technology.

Loopring’s CMO, Jay Zhou, was formerly employed by Ernst and Young, helped found SJ Consulting, and used to work in PayPal’s Risk Operations unit.

Johnston Chen, the project’s COO, has worked as the chief information officer at 3NOD.

As for Loopring’s road map, 2018 is gearing up to be an active year for the protocol’s implementation and expansion. Among other milestones on the roadmap, the Loopring team has the following on their docket for 2018:

- ERC223 support and hybrid trading with these tokens and ERC20 tokens

- Release of mobile wallets for iOS and Android

- Implementing decentralized governance

- Implementing with additional blockchains (NEO and Qtum)

The last bullet point is an integral move for Loopring to become truly a cross-blockhain protocol. Integrating with NEO and Qtum will allow for cross-chain trading, but it will require two new tokens (LRN for NEO, LRQ for Qtum) to achieve this.

Competition

Obviously, Loopring is entering the field of centralized and decentralized exchanges, and on the surface, this makes Loopring look like it’s got some stout competition. But actually, Loopring wants to implement with these exchanges to provide them–and exchangers–with much needed liquidity.

In the realm of decentralized exchange platforms, there are a few cryptos shooting at the same target. 0x is one that comes to mind, but its difference lies in the fact that it allows anyone to run a node as a decentralized exchange. Like Loopring, orders are processed off-chain and all trades are settled on chain, but unlike Loopring, it doesn’t draw from multiple exchanges, as all liquidity comes from exchanges established on 0x’s platform.

Other competitors include Bancor, Blocknet, and Kyber Network. Bancor and Kyber Network offer order matching and liquidity pools to ensure that trades are met across blockchain smart contracts, while Blocknet offers the same services solely through order matching. None of these, however, offer the ring orders that ring matching creates on Loopring’s protocol.

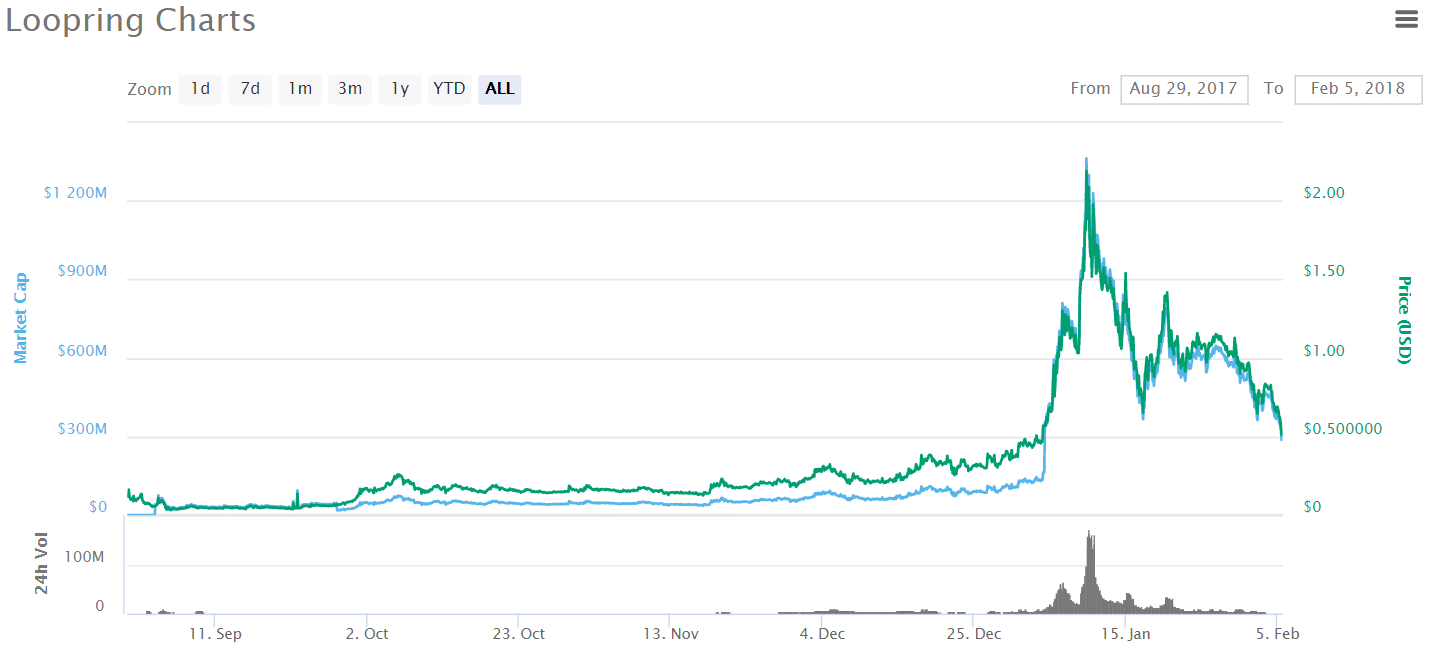

Trading History

At the time of writing, everything is taking a kick in the pants’ seat, and Loopring is no exception.

Back on January 9th, it saw an all-time high of $2.19, and right now, it’s ranked 52nd on Coin Market Cap.

Where to Buy, Where to Store

Loopring is listed on a handful of exchanges, but the majority of its volume comes through Binance, OKEx, and Gate.io. All three offer BTC and ETH trading pairs, while OKEx and Gate.io offer USDT pairs, as well.

Once you’ve bought yourself some LRC–if you want to, that is–you can either head over to loopring.io to use the official wallet and begin exchanging, or you can hold it in an ERC20 compatible wallet.

Final Thoughts

There are a couple of key takeaways from Loopring that distinguish it from decentralized exchanges and other decentralized exchange protocols. For starters, it’s not trying to beat out DEXs and centralized exchanges–it’s trying to connect to them. This has the potential to increase liquidity across all markets that implement Loopring, and it could potentially neutralized arbitrage thanks to lowest-price order matching.

In addition, ring orders separate Loopring from other decentralized exchange protocols. Ring-matching could increase liquidity even further, as it will mean that three or more orders can be paired with each other to execute numerous trades at once. The order sharing also offers advantages over traditional order matching models, allowing for more flexible trading.

Flexibility seems to be Loopring’s MO. It’s blockchain agnostic (so long as that blockchain accommodates smart contracts), can be used by decentralized and centralized exchanges, and can fulfill a single order through multiple avenues. Decentralized exchanges will likely become more popular moving forward as they improve their user experiences. If this proves to be the case, we hope this guide (and others like it) will keep you in the loop on these decentralized solutions as we ring in a new era of cryptocurrency trading.

Additional Resources:

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.