Bharath Rao is the CEO of Leverj, a Plasma-based decentralized exchange. Coin Central’s Munair Simpson had the opportunity to interview him at Consensus last month during Blockchain Week in New York City. We wanted to learn more about what he’s been doing with Plasma and dig into his plans for the Leverj DEX.

Plasma and Leverj

Munair: Last week at the Ethereal Summit here in New York, I met David Knott. He works on the Plasma OmiseGO DEX. He told me a little about Plasma research and development, but I was wondering if you could tell me a little bit more about Plasma and how you’re integrating it into your efforts there at Leverj.

Bharath: Plasma is essentially a scaling solution by Vitalik and Joseph Poon, and I think this is the first real scaling solution for Blockchain that is within reach of the general community. The idea behind Plasma is fairly simple to understand. The idea is that there is a side chain, or a child chain, which is anchored to the root chain.

Everyone interacts with the child chain. Changes are made to the child chain. Periodically, the root chain is updated with sufficient information to verify that everything is going well on the child chain. Everyone abandons the child chain if the root chain determines that things are not going well. This provides a disincentive for the child chain to do anything malicious.

Munair: Now, there are a couple of styles of the Plasma implementation, one is a “Cash” style. It’s a little faster than the original implementation. Which version do you use at Leverj?

Bharath: Plasma people call that original implementation Plasma Classic. It’s very comprehensive and a very large body of work. There are two other specifications which are simpler to start with. One is called Plasma MVP. This is what OmiseGo is working on. There’s also Plasma Cash. It’s slightly different in some respects. Its supposed to be easier to scale, but nonfungible. This means that, if I have a coin, I cannot merge it with another coin to create a coin of the total value. Like Banknotes, you’ll have to keep them separate. You have to trade them separately.

For an exchange, neither of these are appropriate. So we created our own. It’s called Plasma Gluon. The idea behind this is, if you look at the way Plasma is designed, it’s designed to be a scalable coin, and for an exchange, it’s insufficient to just have a coin. You need to be able to actually trade those coins. The way many people are doing it right now is through atomic swaps. This presents a lot of issues for an exchange because we have to have price-time priority. We want to have people place an order, shut down their laptop, and not need to be online when the transaction is matched. We need to be able to match large orders against small orders.

With Plasma Cash this is not easy because you have to split the coins and Plasma Cash does not allow the split. We created our own version of Plasma where we address all of these problems. Our flavor is designed especially for decentralized exchanges.

Munair: Bharath, I want to take a step back. One of the things that we like to do at CoinCentral with our interviews is to talk a little bit about the founding team. I want to dig into your background a little bit more. Could you tell us about your professional experience, how you got into the industry, and what drives you to innovate in this space?

Bharath: I’d been on Wall Street for about 10 years. Then, after the crisis of 2008, I decided to leave. I was disillusioned with the fact that the system appears to work but is really fragile. I moved to the West Coast. I wanted to get into technology. I worked for Motorola Labs, which was absorbed by Google. Then I moved to GE.

During that time, I discovered Bitcoin. Having been a futures trader for 6 years at that point, I decided that this was the perfect vehicle for a trading platform. There is a pure transfer of value, there’s no need to worry about voting rights, dividend rights, and so on.

I started experimenting with creating a trading platform. Eventually, I decided to do that full time. The first version that we developed worked on Bitcoin. At that time there was no Ethereum. Once Ethereum had sufficient traction we realized we could make it completely non-custodial. So we started working on an Ethereum-based platform.

We had most of the pieces in place, but there was one missing piece of data availability. We were lucky that the Plasma white paper was released just in time. Plasma solved the data availability issues. We were able to create a scaling solution that scales and is reasonably decentralized.

Munair: Fantastic. Now a while ago you said “we” many times. Would you like to tell us a little bit about your team and where they are? Are they in California with you?

Bharath: Our team is spread out across the world. My co-founder, Nirmal, he’s been in the trading space for a long time. He’s been writing foreign exchange trading software for about 10 years so he is very aware of the latencies, speed requirements and all of the things that make trading enjoyable and possible for large players.

Our marketing person is Gerry, he is a veteran marketer who has been doing this for many years. He’s in the East Coast. We have a product person, who goes by the handle Swap Man. Everybody knows him that way. He is responsible for the design of most of the paper products that are trading today in the market. We outsource some of the development too.

LEV Tokens and the Leverj Platform

Munair: I want to dive right back into the DEX. Does the Leverj platform use a coin?

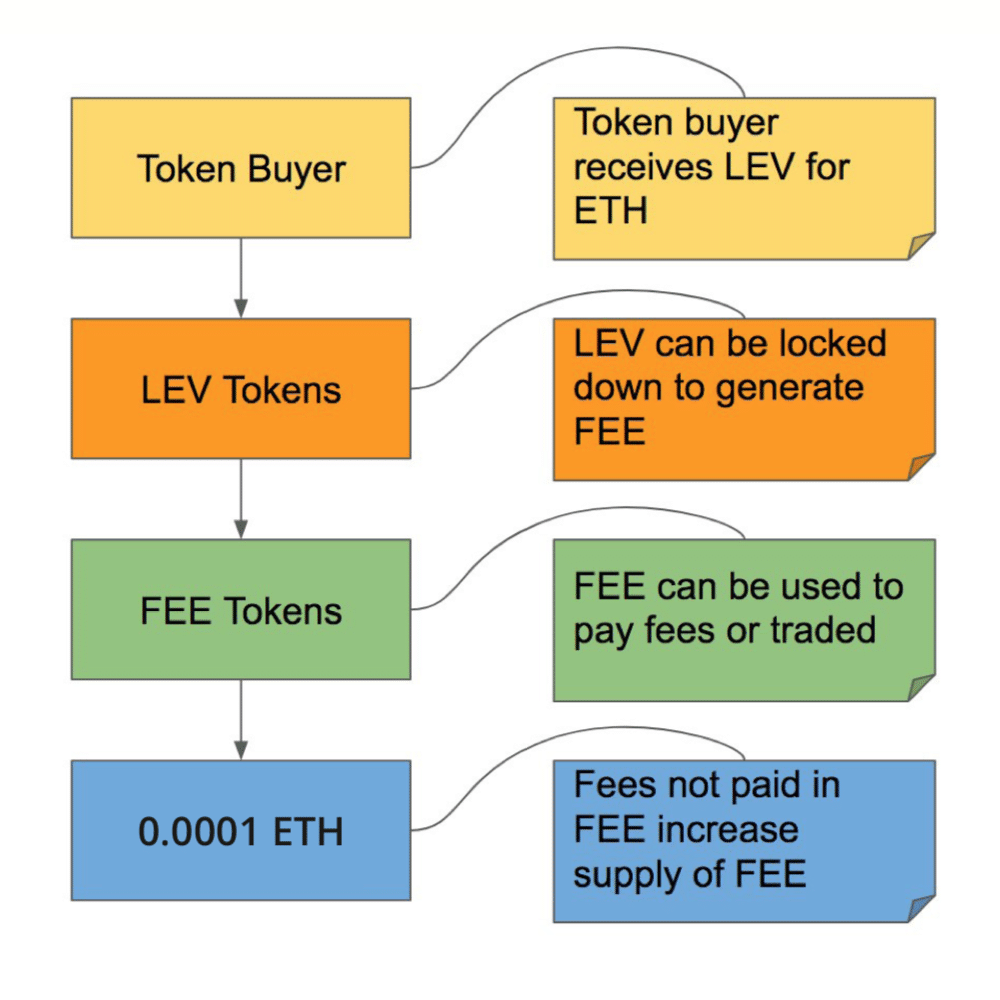

Bharath: Yes, it does. The Leverj platform has a coin called LEV, the LEV token. There is also another token for fees, the FEE token. The way it works is that the LEV token is sort of like a license to use the platform. The FEE token is the means of accounting. You can use all the rights you have but no more.

As people trade, the revenue generated is converted to FEE tokens. This is apportioned according to the amount of LEV you have staked. The ability to stake LEV enables people to essentially trade for free, or as much as they want. They just have to buy LEV and stake it.

If they need more FEE, they can buy FEE tokens from the market. If they have excess FEE, they can offload it in the market. This exists to stabilize the economy of the platform.

It’s insufficient to just create a token and say, “Pay fees with this, we will burn it,” or something like this. I think that’s a really artificial way to do something. In our system, economics is essentially the principle behind the design of the tokens.

Munair: Just for users understanding and clarification, I wanted to drill a little bit deeper with the LEV token, can you tell us a little bit about the supply? Is the supply fixed? What about FEE? Can you talk a little bit about its tokenomics?

Bharath: LEV has a fixed supply. The fixed token generation is already done. You can trade it like any other ERC20 token. It’s listed on OKEX for people who want to get in and get out. We expect a lot of traders to start trading small amounts of LEV because ours is a new platform. Once they get more comfortable they will probably buy more LEVs so they can stake more.

The FEE token has a varying supply. What we have done is we have separated the value from the utility of the tokens. If you try to tie both into one token, like some of these other utilities have, what happens is as the price fluctuates it impacts the incentives. Because we separate the two, you can–

Munair: Erase the conflict.

Bharath: Exactly.

Munair: I call it the token dilemma.

One of the things some of the users of cryptocurrency exchanges are very concerned about is stable coins. Would you like to say if you have any plans to introduce a stable coin? It seems from the explanation of both LEV and FEE that, as the Leverj platform grows and does very well, the value of LEV will increase. FEE is tied into that, but it’s not going to be a stable store of value. Do you have any plans to work with a particular stable coin?

Bharath: We don’t want to create our own stable coin at this moment. I think there are many teams that are doing this already. We don’t want to just replicate everyone’s work. Our team has the ability to pick one of the already successful stable coins such as Tether or DAI and let people trade against it. If they want to park their value in one of the stable coins, they are free to do so on the exchange. That enables them to mitigate risk as they see fit and take exposure as they see fit.

Munair: Got it. I wanted to jump over and talk a little bit about liquidity. One of the things that DEXs really have a problem with is how to get trading pairs active and provide value in this space. Would you like to tell us what plans you have?

Bharath: The reason DEXs find it hard to attract liquidity is that DEXs are very expensive for the market maker. In many of the DEXs today, like EtherDelta and so on, you have to pay a fee to cancel an order. As a market maker, you cancel 98% of your orders or even more. Only about 2% are filled. Now if you have to pay gas as well, your cost is almost two orders of magnitude higher. Furthermore, the varying costs of the gas and congestion mean that you cannot actually model your cost at all.

In a business where the margins are razor thin, you have a razor-thin edge that you multiply millions of times to stay profitable, if you cannot model your cost and risk then that margin of profit is likely to go below zero. You run the risk of huge losses instead of making a profit.

This is why almost every DEX is going to find it very hard to find market makers. In our case the order book is off-chain, the matching is off-chain, there is no cost related to the blockchain for anything except deposits and withdrawals, just like a centralized exchange. For us, it’s a lot easier to get market makers. We have already signed an agreement with Smart Contract Japan, which is one of the biggest OTC traders in cryptocurrency world. We also have a lot of other traders who have a special interest in making markets for our products. So I feel that as far as DEXs go we are in a much better position to provide liquidity.

[thrive_leads id=’5219′]

Munair: Fantastic. Would you like to talk about the community right now, maybe anybody who took part in the beta testing?

Bharath: Yeah, so we actually are launching a beta program and we have a set of people who are part of a closed beta. It’s by invitation only. They are testing the product, they are getting feedback, and once it goes beyond a certain state of stability, we’ll open the beta to everyone else. So generally, on testnet and once we have audits of the small contracts and security bounties, we are confident that we are willing to let people put millions of their money into the system, we will open to the public.

Munair: I want to talk a little bit more about marketing, for example, target markets, positioning and also the state of the DEX playing field. I don’t want to call them incumbents, but there are guys like Radar Relay who are doing something already in a decentralized space and getting a lot volume. There are guys doing stuff on-chain, like IDEX, which also have good volume. Where do you position yourselves and how are you differentiating yourself from the pack?

Bharath: IDEX is a great use case. IDEX and Leverj have a similar outlook about what DEXs should be. We understand what the order book is. We understand the importance of price-time priority. The reason IDEX has been dramatically more successful than other DEXs is that it centralizes the order book and matching. It only uses the chain for the actual settlement. Whereas the other DEXs that do more things on-chain, require fees to cancel, they won’t have that kind of traction.

Maybe Radar Relay existed before IDEX. I’m not exactly sure, but IDEX has really overtaken the exchanges by volume. We believe that we will also have similar traction or better traction than IDEX because we have even less involvement on-chain and we actually have market makers who want to market make for this so I feel that is the differentiation.

Munair: Now, lastly, we talked a lot about Plasma and Plasma Classic at the start. We covered the things that you guys have been doing and the modifications that you’ve made. For the really technical members of our readership, would you like to let us know some of the performance that people can expect? For example, on EtherDelta, the settlement time is quite long. Everything is done on-chain. For traditional centralized exchanges, however, where order book matching takes place in fractions of a second, in the milliseconds…

Bharath: Right, that’s our goal. Our goal is to have a trading near real-time as much as possible so you’re able to buy and sell immediately within milliseconds. The only delays would be due to network delays, so if you are in a different continent, you are going to have a hundred second millisecond delay when you send orders and other than that you should really see nothing else. That’s our goal because the blockchain is not involved and the actual critical part, placing the orders, canceling the orders, matching the orders, you are only involved when you deposit and withdraw, you should see no difference from any of the centralized exchanges.

Munair: To sum it up, basically we are saying that Leverj is going to be a non-custodial platform. There are deposit and withdrawal fees. Through staking LEV, the token of the platform, people can avoid or reduce fees which are payable in FEE tokens. Is there any asymmetry in the marketplace? Is there a higher transaction fee for market makers versus the takers of liquidity?

Bharath: In general, most exchanges in crypto, they have no, or low, fees for maker orders and they have slightly higher fees for taker orders. We have the same structure. In our case, you could always stake your LEV and spend the FEE you earn to cover your fees.

Depending on your operating style, if you are someone who puts a lot of limit orders, then maybe you don’t need a lot of LEV. If you are someone who likes to get in and get out quick, you do market buy and market sell, you just get a little bit more LEV and stake more of it. Our system gives you the flexibility to plan and model your expenses. You use our staking system to cover your cost.

Munair: Bharath, is there anything you’d like to let the CoinCentral community know about your platform that I haven’t already asked you about or that we haven’t discussed?

Bharath: We are a really community-focused development group. Please join our telegram and give us suggestions. You should try out the product. We have bounties for bugs. If you have great suggestions, any kind of contribution, we try to make sure that you are fairly compensated. We want to build something for you and by you. So feel free to join and contribute.

Thanks Bharath and the Team at Leverj!

We’d like to thank Bharath Rao again for taking the time to sit down with us at Consensus. To learn more about Leverj, check out the website, white paper, blog and Telegram channel.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.