Bityard is a Singapore-based cryptocurrency derivatives trading platform on a mission to simplify leveraged contract trading, with a “Complex Contracts, Simple Trade” approach.

The platform is relatively new and is likely to attract attention from many cryptocurrency traders considering options trading, but haven’t yet made the leap to an options-oriented platform (such as BitMEX).

Bityard currently offers trading for 8 different cryptocurrencies with a leverage of up to 100x. Readers should note that this article isn’t investment advice. Margin trading can be very risky, do your research and consult with a licensed financial advisor as necessary.

What is Bityard?

Bityard is a privately held cryptocurrency contracts exchange that seeks to differentiate itself by providing easy, fast, and safe cryptocurrency asset contract trading.

Launched in November 2019, the holding company is based in Singapore and has its primary office listed at Paya Lebar Square. Bityard doesn’t use order books– the exchange matches user trades itself. This helps to avoid slippage in the trades.

To understand Bityard better, let’s go over cryptocurrency options trading in general.

What is Cryptocurrency Option Trading?

Readers should note that Bityard differs from a traditional cryptocurrency exchange in that its primary value is providing cryptocurrency option contract trading– and not actual cryptocurrency-to-cryptocurrency exchanges.

When using BitYard, you are not “buying” Bitcoin or Ethereum, but rather buying an options contract.

Contracts are trading instruments that enable investors to trade on the price movements of an asset without actually holding the asset. For example, these contracts can be held on physical commodities like rice, crude oil, or chickens, or financial instruments like bonds, stocks, and digital assets.

Buyers and sellers usually use contract trading as a way to hedge and minimize risks, protect against volatile future price swings, and speculate on the assets. Contracts involve buyers, sellers, and an agreed price.

For example, let’s take a look at Bitcoin options trading on Bityard. Users are able to purchase a USDT-BTC option contract with up to 100x leverage and not actually hold the BTC asset.

Bityard offers cryptocurrency margin trading, meaning that a trader would only need to put down a fraction of the full trade amount in a leveraged position. Cryptocurrency margin trading on Bityard is a relatively simple process.

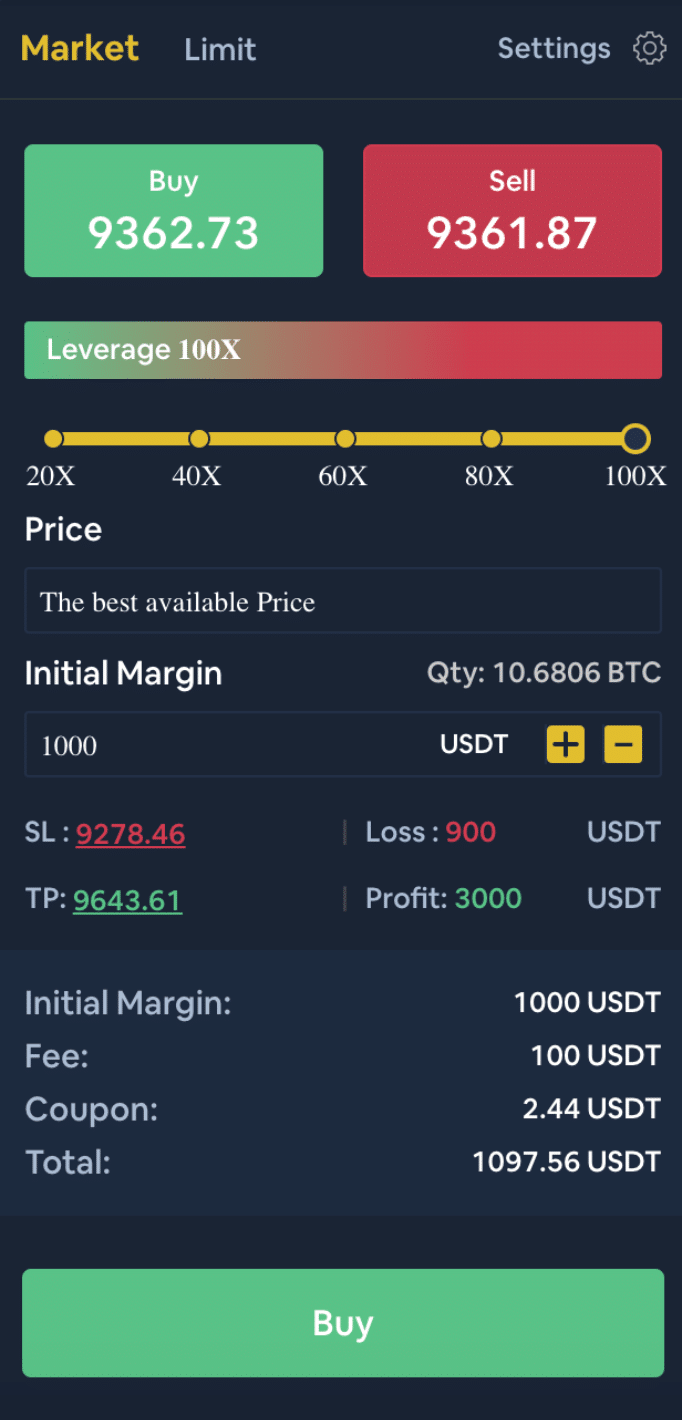

For 1000 USDT and 100x leverage, we would reach an initial margin of 10.6806 BTC (1000 USDT x 100 equals about 10.68 BTC at the current prices). We would also pay about 100 USDT in fees to purchase the contract with 100x leverage.

If the BTC price were to drop to 9278.46 (the SL “stop loss”) the contract would close and we would lose 900 USDT– yikes.

If the BTC price were to hit 9643.61 (the TP “take profit”) we would profit 3000 USDT, which is 3x our starting investment– not too shabby for a relatively marginal price increase.

The upside is theoretically infinite (unless the contract is set to auto-execute at a certain price), but the downside can be brutal.

Comparatively, if you were to purchase BTC the asset for 1000 USDT, the BTC price would need to hit about 30k per BTC to make a similar profit. It would also need to shrink to a tenth of its value ($960) for you to experience a similar loss.

Cryptocurrency options and margin trading can be very risky. While Bityard does seem to make margin trading very user-friendly, we implore our readers to do their due diligence on how margin trading works.

Skilled traders are able to utilize cryptocurrency derivatives to hedge trading risks, but this takes plenty of research and testing to get the hang. If you approach margin trading after thoroughly researching it, even with caution, you can still get burnt.

Here are a few notable benefits of cryptocurrency derivatives contracts:

- Hedging Risks

Investors can mitigate the risk of a falling price by simultaneously taking a “short” position on the digital asset in question. So, if the price falls, the “short” position will mitigate losses by providing additional revenue. Contract traders can avoid the risk of holding the volatile asset while still maintaining some upside to profit from its price movements.

- Speculating on Market Direction

Cryptocurrency contract trading makes market speculation much more aggressive as traders don’t need to hold the asset to influence the price. For example, if someone thinks BTC’s price will moon, they can go long on Bitcoin futures. If they think ETH’s price will crash, they can short ETH.

- Stabilizing Price Fluctuations

Speculation tends to have a negative reputation, but it can help mature markets and stabilize them in the long run. In the past, cryptocurrency options trading has also increased the volatility of asset prices and has been linked to Bitcoin price swings.

Bityard Competition

Bityard does a fairly good job of differentiating itself in the cryptocurrency options trading space with low entry levels, unique complex contract offerings, and a simple user-friendly interface.

Bityard’s competitors include BitMEX and Prime XBT.

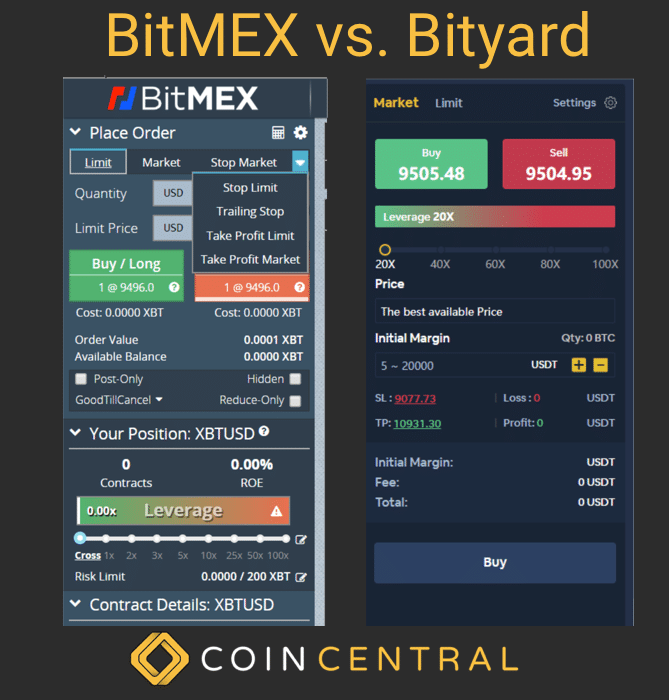

While cryptocurrency margin trading and cryptocurrency options trading can be viewed as incredibly complicated by beginners, Bityard is trying to make the process much easier to understand for new users. In a brief BitMEX vs Bityard comparison, Bityard is much simpler and cleaner in its interface, which is likely to not terrify new users as much.

This isn’t to knock BitMEX as a platform, as it seems both platforms are able to function properly and keep their users happy. It seems that Bityard is primarily better suited for newer traders, whereas BitMEX is going after the more advanced crowd.

Bityard also has a brand ambassador, Buakaw Banchamek, a world-famous Muay Thai champion. What do leveraged cryptocurrency option trading and lethal head kicks have in common? We’re not sure. However, it does show an incentive on Bityard’s part to embrace a user base that is not traditionally well-versed in the cryptocurrency option trading.

Bityard has a maximum 100,000 USDT withdrawal limit.

Bityard Fees

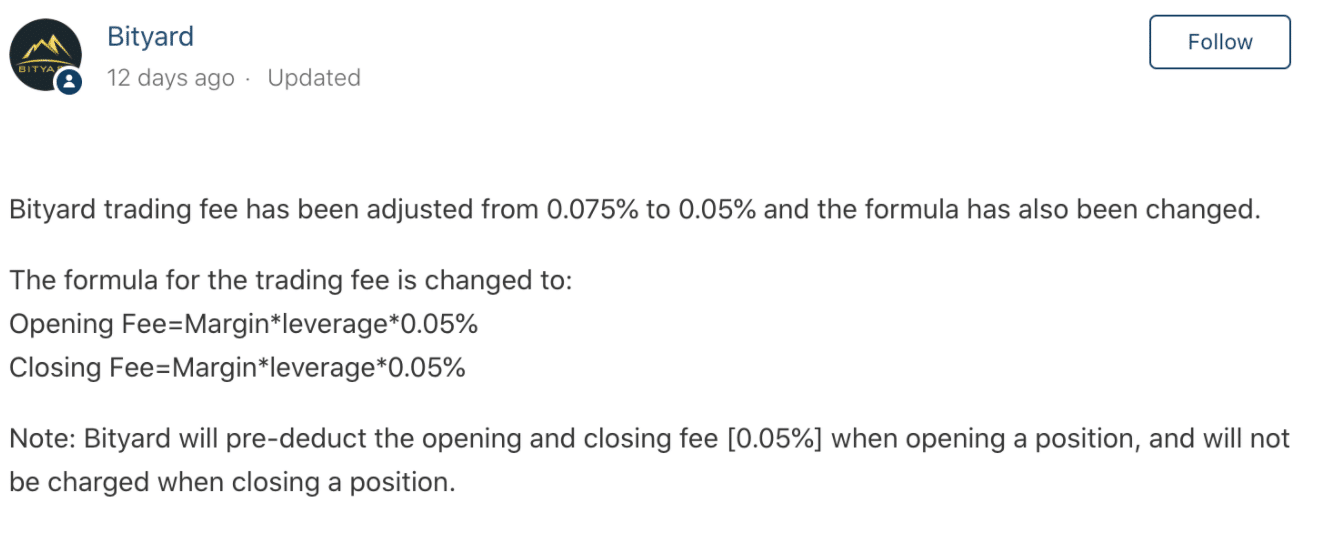

Bityard currently offers a .05% transaction fee, which is lower than the industry standard of .075% (BitMEX, Bybit, Deribit).

The Court of Public Opinion: Is Bityard Good?

Since Bityard is still relatively new, there hasn’t been much discussion about the platform online. However, it does boast an active Telegram community and social channels.

Bityard Customer support is available via email, Telegram, and online. Bityard also has plenty of specific answers in their beginner guides.

Many of Bityard’s users seem to enjoy the platform’s simple and intuitive user interface

Is Bityard Safe?

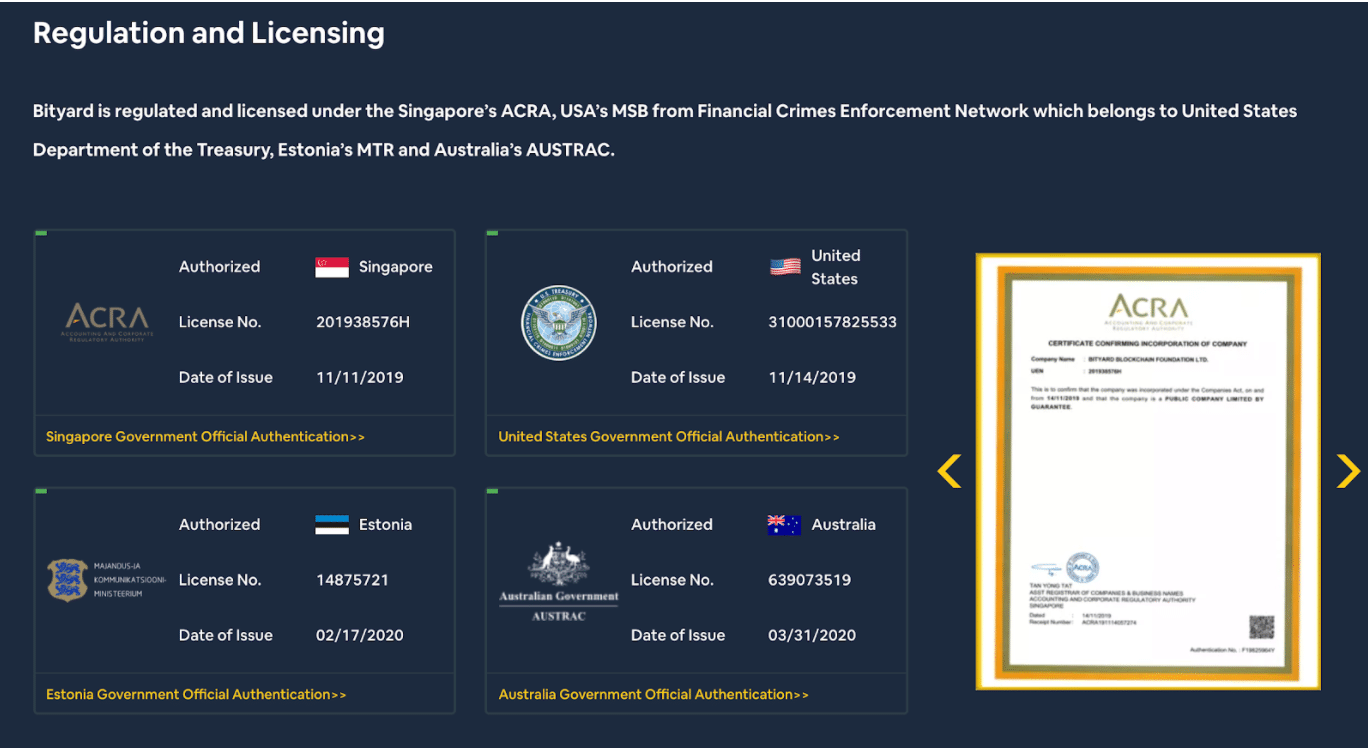

Bityard is one of the few cryptocurrency leveraged trading exchanges with regulatory licenses in Singapore, Estonia, Australia, and the USA. Since its launch in 2019, Bityard has expanded its offering to over 150 countries and has translated its website into eight languages: English, Russian, Simplified Chinese, Traditional Chinese, Vietnamese, Korean, Japanese, and Indonesian (and Portuguese soon).

Regulation: Bityard is regulated and licensed under Singapore’s ACRA, USA’s MSB from Financial Crimes Enforcement Network which belongs to the United States Department of the Treasury, Estonia’s MTR, and Australia’s AUSTRAC.

Fund security: Bityard uses multiple offline cold wallets to protect user funds from hackers, with a smaller portion in “hot wallets” online to be used to pay withdrawals and take deposits. Bityard also has a user security menu to help users optimize the security of their accounts with features such as 2FA.

Bityard utilizes real-time risk auditing and risk management tools to monitor market exposure and positions for each user partaking in cryptocurrency options trading and cryptocurrency margin trading.

With 24/7 online support and the above certifications, Bityard seems safe, but we remind our users to be cautious of the risk that comes from using any platform online. Be sure to store your digital assets like Bitcoin in a safe cold wallet.

How to Get Started on Bityard

As a user in the United States, our set-up was extremely frictionless– all it took was an email address, a password, and a Captcha to get started on Bityard. There wasn’t any KYC or identity verification required.

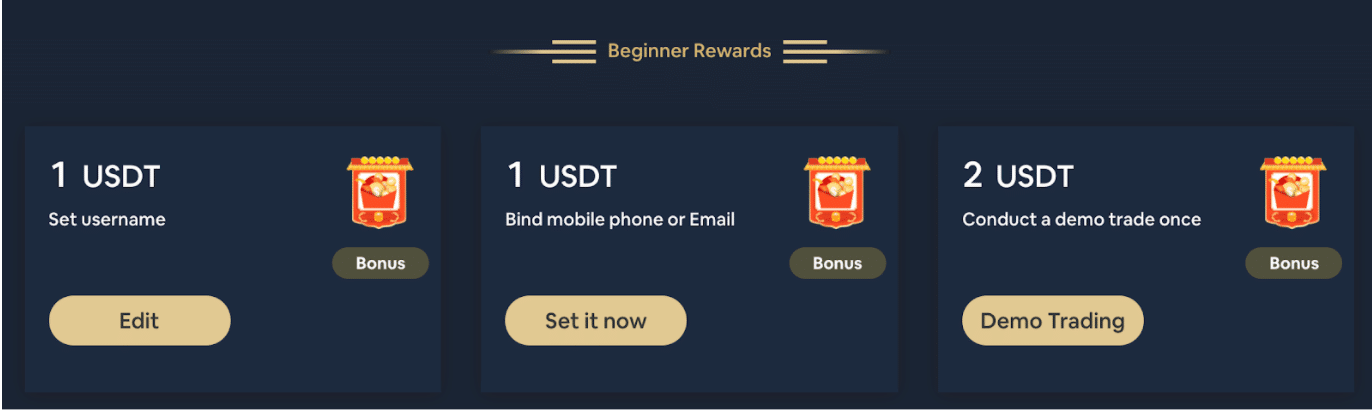

The exchange has a few “beginner rewards” to add more details to your account and familiarize yourself with the platform. These rewards are added as coupon credits for the fees.

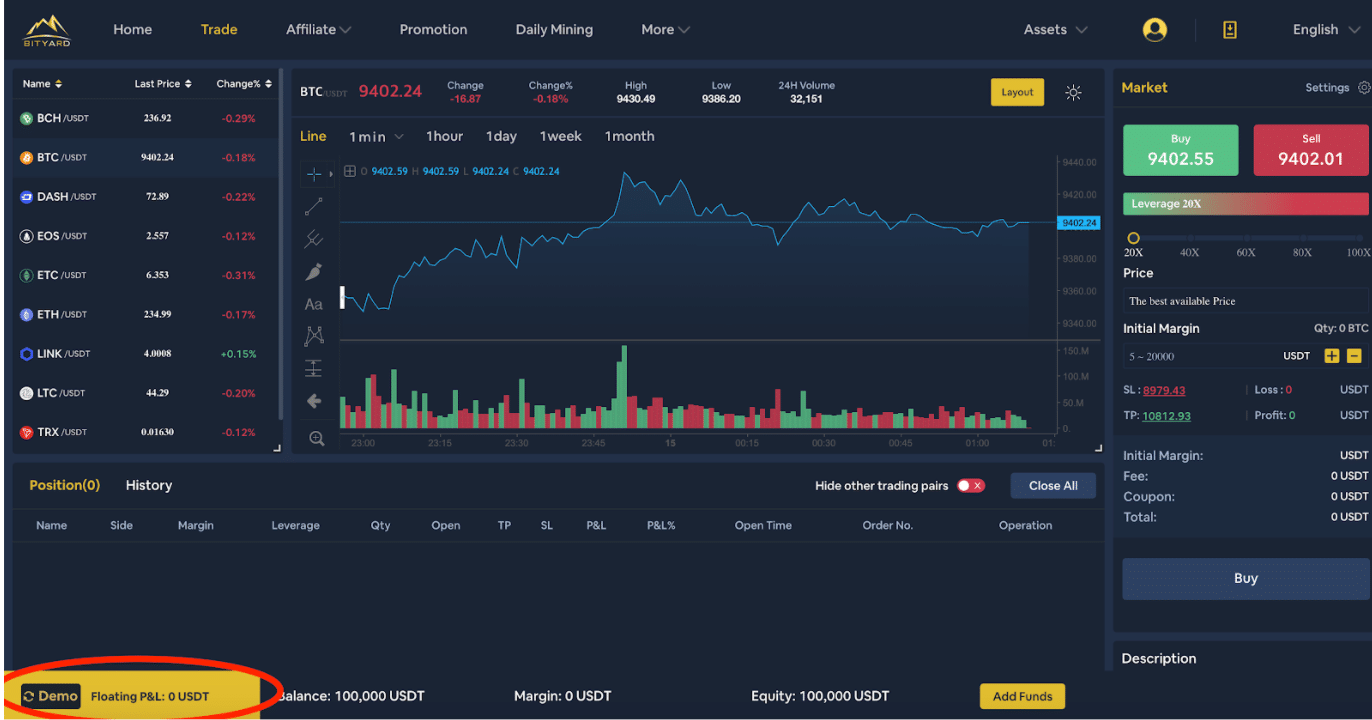

Bityard also has a “demo trade” feature, in which the interface changes into demo mode and traders can do “demo” cryptocurrency options trading using real price charts and volumes without having to commit real assets. Users can start leveraged contract trades to get a feel for the functionality of the platform.

However, be vigilant when using this feature, as the trading view is identical except for the “mode” options in the bottom left. Make sure it says Demo if you want to demo trade (and vice versa!)

Bityard offers fiat deposit and supports multiple mainstream digital currencies such as BTC, ETH, XRP, USDT, TRX, HT, LINK. Fiat support is offered for RMB (China), Vietnamese Dong, Indonesian Rupiah.

The platform also offers OTC services for buying USDT.

*Fiat deposit gateways might not be available in the United States, as they weren’t for us when we made our account.

Meet Bityard’s Platform Coin – BYD

Bityard also plans to roll out its own platform coin, BYD, an asset similar to Binance’s BNB that is expected to be used to reduce trading fees and facilitate other ecosystem incentives.

Users are able to “mine” BYD and other digital assets on the Bityard site by clicking on the icons as they’re ready once per day.

*BYD is currently not tradeable or exchangeable.

Final Thoughts: Is Bityard Legit?

Cryptocurrency contract trading platforms have come a long way, and Bityard seems to be leading the pack in terms of simplicity and user-interface. The fact that Bityard has a well-functioning mobile app is impressive since mobile derivatives in general are still relatively new.

Bityard is relatively new and there isn’t much to detract from the exchange’s legitimacy. It seems like a straightforward user-friendly platform for cryptocurrency contracts trading. However, the biggest risk with any cryptocurrency exchange or contract trading platform is usually the human propensity for error (losing funds due to poor account security or sending them to invalid addresses) or excessive risk.