2018 has been the polar opposite of 2017. Cryptocurrency prices were flying and doubling with sporadic timing. Cryptocurrency “investors” playfully spammed Moon and Lambo tweets. ICOs were the talk of the 2017 town. Today, things are different, especially for the once praised new way to raise capital.

Dropping nearly 88% from its January 2018 ATH, Ethereum has been the cause of panic and stress for many ICO projects. These projects responded to the consistently dipping Ethereum prices by dumping their treasuries of the raised Ethereum. Each month the price fell, more Ethereum was dumped, creating a vicious cycle that has left some questioning the longevity and potential of not only just Ethereum, but ICOs and tokenization in general.

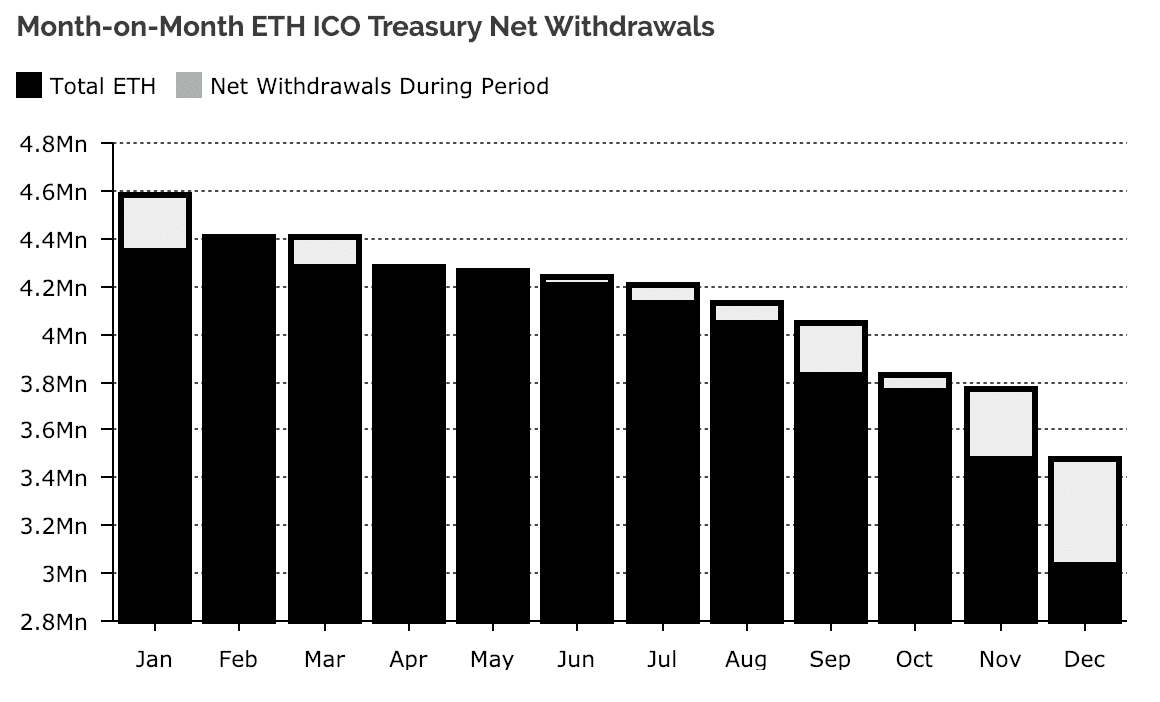

According to a report by Diar, nearly 24% of the 100 wallets in the report has been sold off.

Last year, Filecoin broke the record for the amount of funds raised via ICO. This year, it seems like it’s going to break the record for the highest amount of ETH dumped post-ICO. This December, Filecoin off-loaded 216,906 ETH, the equivalent of around $29.2 million USD, a drastic leap away from 246,839,028, that amount was worth early 2018. $29.2 million is no small chunk of change for a startup, but still.

Other notable projects did similar comparable sell-offs of their hard-raised ETH: Status (20,000 ETH) Singular DTV (52,068 ETH), Kyber (66,454 ETH), Fusion (9595 ETH), 0x (11,000 ETH), BAT (16,000 ETH), Substratum (8,931 ETH), among others.

The total amount of ETH offloaded in December totaled 433,000 ETH (roughly $58 million), making it the largest withdrawal period of the year, beating out the old champ November.

So, What Does the ICO ETH Sell-off Mean for Us?

While projects that ICO’d selling all their Ethereum may be alarming, and an argument can certainly be made for that alarm, it may just be more indicative of the challenge these projects collectively have to face.

Launching a high-tech startup built around relatively new technology in an unknown regulatory environment with no product, an ambitious roadmap, and a reserve of cash that seemingly halves every few months essentially as high risk of a company as you can be without selling illegal narcotics.

When hundreds of crypto entrepreneurs play the startup game on EXTREME HELL BOSS mode, there are mission-critical questions that pop out of the ether. Do we hold onto our Ethereum and hope our cash run-way doesn’t shrink from a few years to a few months? Do we jump onto the lifeboats, or do we stay on a ship taking in more water every month?

The decision seems split. Projects like Golem, Iconomi, and Airswap haven’t moved any of their Ethereum from those wallets.

Overall, with dozens of cryptocurrency based startups selling their ETH for USD, they’re essentially mitigating a large amount of their risk. Instead of clinging to a vicious bear market, they can now work on the cryptocurrency ecosystem with some sort of insulation. Even with exiting with a fraction of what they fundraised, these startups likely still have enough runway to further implement themselves into the greater tech ecosystem.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.