IDEX and AURA

IDEX recently became the most popular decentralized exchange on the market. At the time of writing, it ranks in the top 70 of exchanges on CoinMarketCap with anywhere from $5-10mln in 24/hr volume daily, replacing EtherDelta as the one-stop-shop for ERC20 tokens.

IDEX’s innovative design is part of what propelled it to this position. We won’t go into too much detail here (he have an IDEX exchange review for that), but basically, it’s designed like a hybrid decentralized/centralized exchange. It’s decentralized in the sense that on-chain smart contracts manage user funds, trading, and settlements, but it’s centralized in the sense that off-chain servers are responsible for maintaining the orderbook, updating balances on the IDEX website, and dispatching trades to the network. So while users always have custody of their funds and trade peer-to-peer, the exchange broadcasts these trades to the network for the users.

It gives users the security of a DEX with the convenience of a centralized exchange, but the tradeoff is that the exchange is not completely decentralized. The exchange offers such novel features as its “escape hatch,” which allows users to withdraw tokens directly from the exchange’s smart contracts should its DNS be compromised or its servers go down. However, such decentralized features that protect user control exist alongside centralized ones like exchange-dictated transaction dispatches.

But the IDEX team has plans to clean up these breadcrumb traces of centralization, and these plans come in the form of the AURA token.

What is AURA

AURA is a staking token that will ensure the integrity of the network (and its node operators). The staking model is, perhaps, IDEX’s largest step towards complete decentralization.

Simply put, IDEX will replace its off-chain database with a decentralized network. Nodes will be responsible for maintaining an orderbook and off-chain information (e.g. user balances) and keeping this data synchronized with all nodes on the network. After this phase, IDEX will move towards a sidechain infrastructure in the second phase of development. This phase will also decentralize the transaction arbiter (the part of the exchange responsible for broadcasting trades for its users), as the arbiter will be built into the mining code that nodes must execute to settle trades.

So what’s keeping node operators from acting up? That’s where AURA comes in. Operators will be required to stake AURA to run a node, and if they behave properly, they’ll receive trading fees for maintaining an honest exchange gateway. If not, then they’ll be penalized and lose part of their stake.

“AURA is a form of collateral, almost like an escrow,” Aurora CEO Alex Wearn told CoinCentral in a phone conversation. “If you cheat the system, you lose that collateral.”

Node operators can expect 50% of all trading fees, while the other 50% will go towards platform development and a reserve fund to back the Boreal, a stablecoin IDEX is developing (more on this below). These fees will be calculated based on such factors as the node’s trading volume and how much AURA the operator has staked.

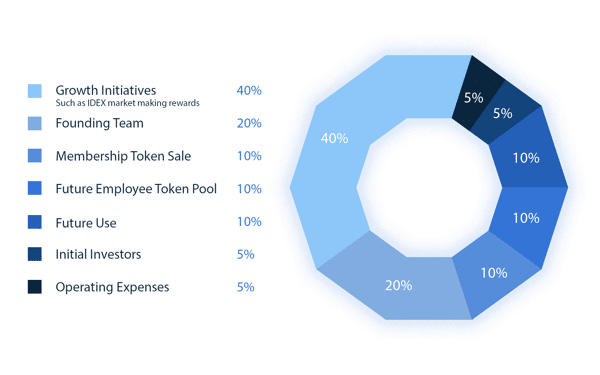

To ensure it functions as intended (i.e., as an incentives token and a source of funding for IDEX), the AURA token supply will be slowly released over a period of five or more years. 10% (100mln) has already been airdropped to IDXM holders (a membership token that IDEX sold in a public distribution). Another 20% (200mln) has been placed in a reserve that will be paid out 50/50 to market makers and takers based on their monthly contributions to IDEX. The idea behind this market maker program is that 1% of this reserve will be split monthly between exchange users proportional to their trading volume for that month.

Another 20% will likely be used for Aurora growth initiatives, which includes furthering the development of the boreal. Like Tether, the boreal will be a stablecoin, but it won’t be managed under a third-party custodial model. “The idea with the boreal is that, within the exchange there’s a source of reserve,” Alex told us.

Thus, the reserve will be intrinsic to the exchange, and the IDEX team envisions it as a base currency for the exchange in the future, one that users can trade in for fee discounts (like Binance coin). Long-term, however, the team won’t be satisfied with boreal adoption just on their exchange–they’re going after the whole market.

“The end goal would be to get other application, other DApps to adopt the boreal,” Alex revealed in our conversation.

Wrapping Up

Above all else, the AURA token shows that the IDEX team is focused on evolving their exchange. It’s a thoughtful and innovative method to pave the path towards complete decentralization on their platform, and it’s also laying the groundwork for incentives that will likely cement a loyal user base.

And in the foreground of AURA is the boreal, IDEX’s forward-thinking solution for a stable-coin alternative to Tether. Both coins represent the range and scope of IDEX’s vision: far and wide. The team is in this for the long haul, as these innovations suggest, and it’s their hope that these additions to the platform will help establish it as the premier decentralized exchange–and perhaps the first ever of its kind to challenge the daily volume of the more popular centralized exchanges.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.