- What Is DeFi Llama?

- How Does DeFi Llama Work?

- Are There Any DeFi Llama Alternatives?

- Final Thoughts: Future Plans For DeFi Llama

DeFi Llama is a decentralized analytics dashboard that tracks DeFi TVL (total value locked) for projects like Ethereum, Terra, and Binance.

Currently, DeFi apps are somewhat difficult to track because of their decentralized nature, with investors having to check each individually to keep up to date with the market. DeFi Llama aims to solve that.

DeFi Llama provides detailed information for investors for free by analyzing data across the world’s largest chains,

That’s data on a $172 billion market without spending a penny. A pretty good offer if you ask us.

To provide users with as much information as possible, DeFi Llama tracks the following:

- DeFi applications

- DeFi chains

- DeFi forks

- DeFi airdrops

- NFTs

- Oracles

The following DeFi Llame guide will cover what DeFi Llama is, how it works, how to use DeFi Llama, and its competitors.

What Is DeFi Llama?

DeFi Llama is an API that tracks DeFi LTV to give an overview of the world’s largest chains and the total value of the DeFi market as a whole. Blockchains include:

- Ethereum

- BSC

- Terra

- Tron

- Avalanche

- Solana

- Polygon

- Cronos

- Fantom

- Waves

And many more.

The platform sources its info directly from over 80 Layer one blockchains, hundreds of decentralized apps, CoinGecko and Uniswap. CoinGecko tracks over 400 exchanges and 5000 DeFi assets, making it one of the world’s largest cryptocurrency data aggregators. Uniswap provides information on thousands of cryptocurrencies and is one of the largest decentralized exchanges with over $100 billion in total trading volume.

By compiling this data, users can easily see which chains are the largest and which are growing fastest. The data is reliable as it comes from open protocols where blockchain data is available to the public.

In December 2021, DeFi TVL reached an all-time high of $250 billion (valued at $19.5bn in September 2020), showing how quickly the market is expanding.

How Does DeFi Llama Work?

Above we established that DeFi Llama aggregates information from blockchains to provide users with data. But how exactly does DeFi Llama work?

Before we start, it’s important to note that TVL differs from the market cap. In terms of market cap, Bitcoin is by far the largest cryptocurrency. However, it doesn’t support smart contracts, so DeFi applications can’t be built on them. Therefore, it’s not listed on DeFi Llama.

Here’s how to use DeFi Llama.

DeFi Llama Dashboard

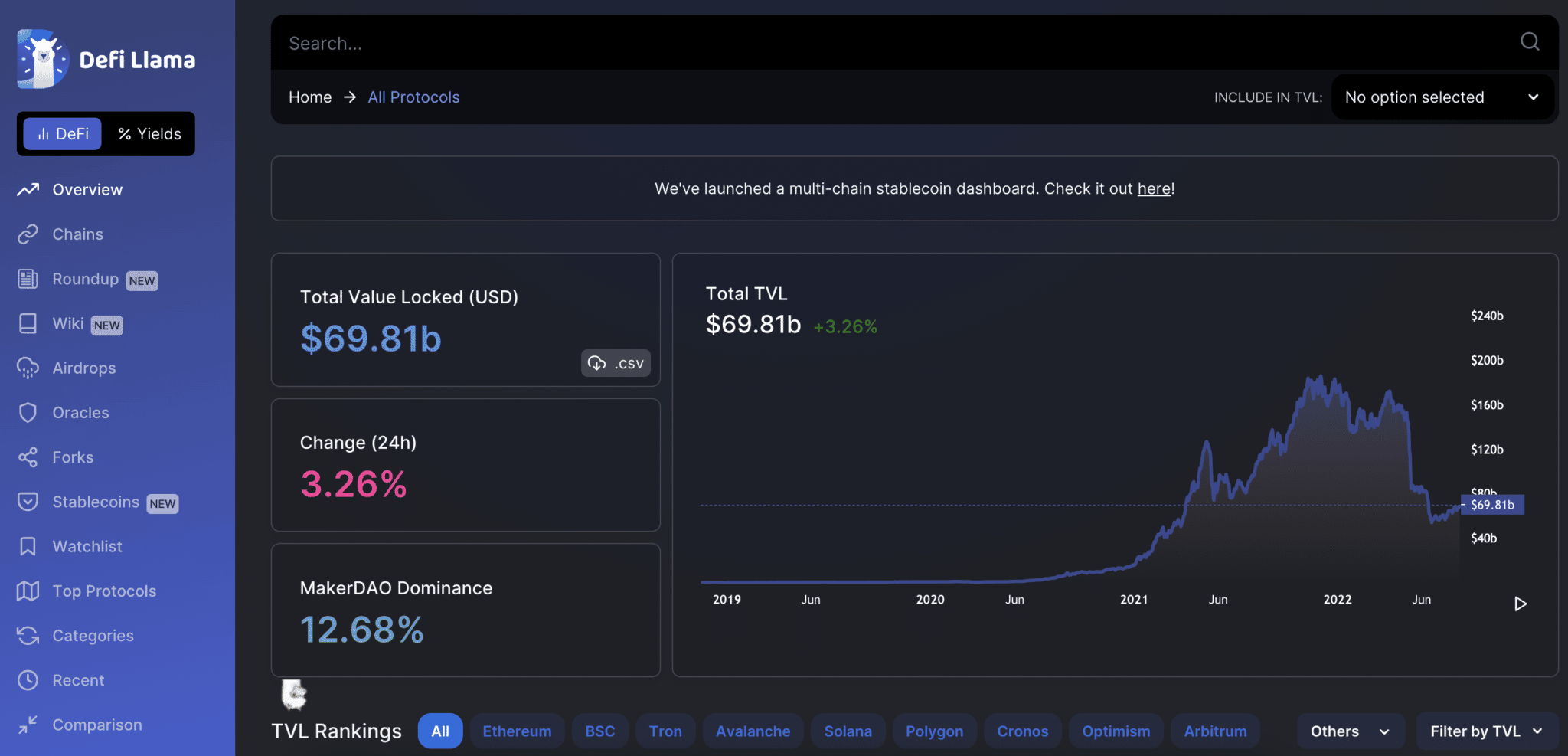

Upon entering the site, you’ll go straight to the DeFi Llama dashboard showing a chart of DeFi TVL across different activities. These include TVL rankings based on USD, the TVL of different blockchains, protocols, and the percentage change over one day, seven days, and a month.

According to the July 2022 dashboard, MakerDAO (MKR) has the highest TVL with $8.43b in assets, with Lido (LDO) in second place with $7.08b.

Users can scroll through TVL rankings based on separate chains such as Ethereum, BSC, and Tron or choose a generic overview of the market.

On the left-hand side of the dashboard, you can also find individual sections, including

- Chains

- DeFi Forks

- Airdrops

- Oracles

- Stablecoins

Here’s how they work.

DeFi Chains

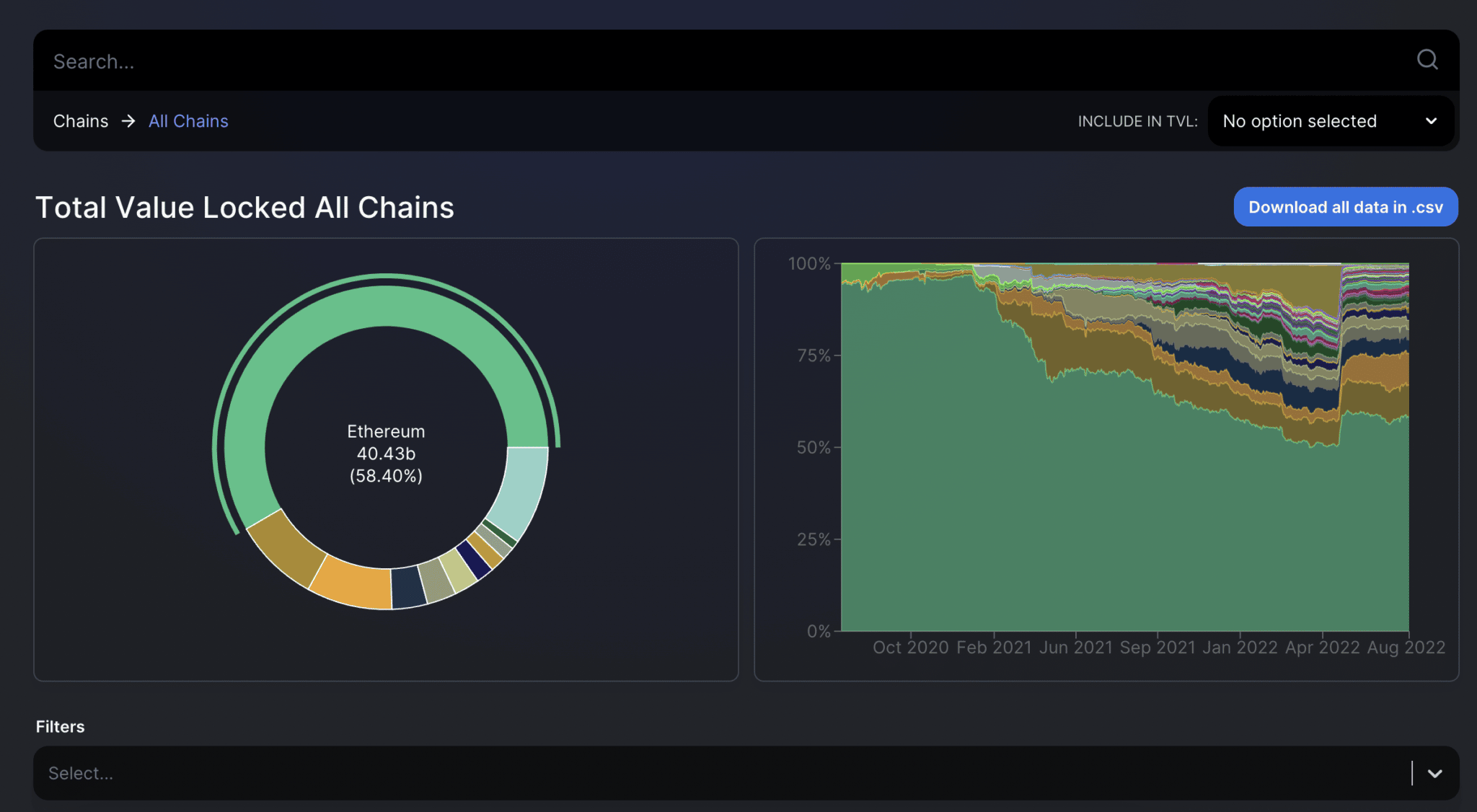

Under the “Chains” menu, users can check the TVL of the largest blockchains. Once users click the Chain button, they will be taken to a list of Layer 1 chains where apps can be built.

The top DeFi chain is Ethereum, with a market share of 58.7% and a TVL of $39.45b. Despite seeming like an overwhelming majority of the market, Ethereum’s market share has fallen since 2021, representing 95-97% of all DeFi activity.

Since its all-time highs, apps such as UniSwap and OpenSea have innovated blockchain technology creating new options for decentralized trading. Many of these can be found under the Chains heading, including Solana (SOL), Tron (TRX), and Waves (WAVES).

DeFi Forks

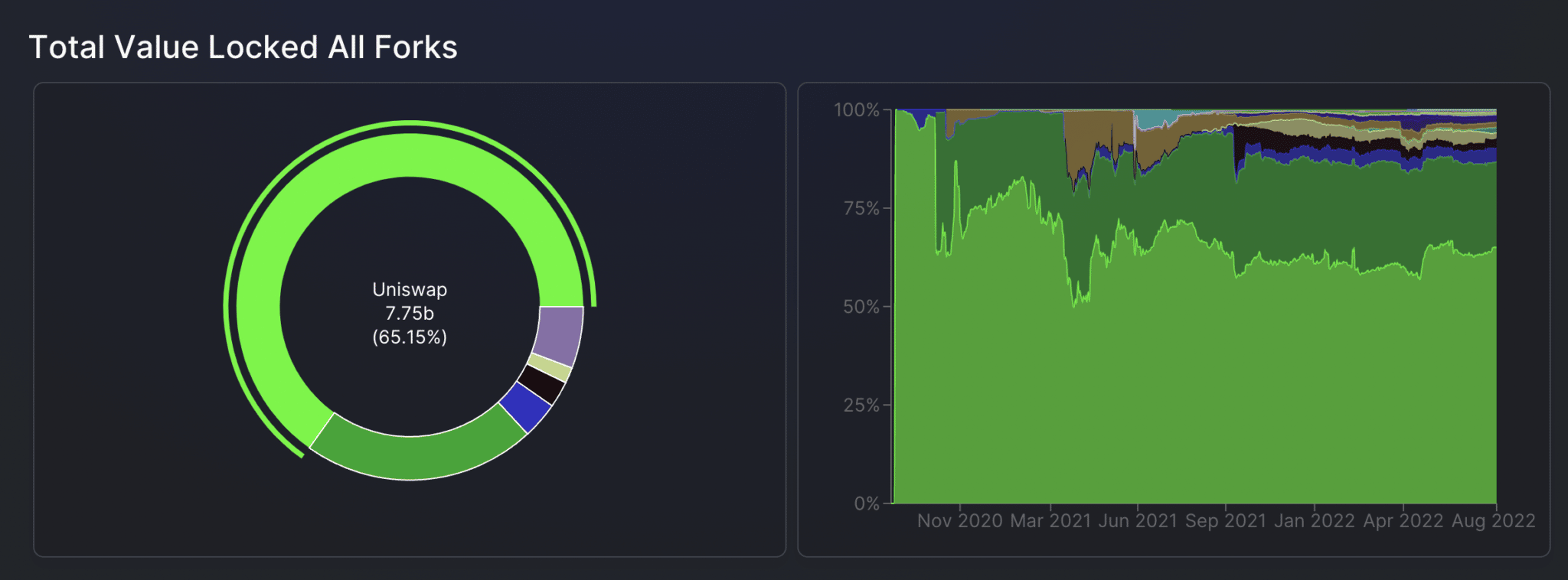

A fork is a copy of original software that’s been slightly altered to make improvements. Most DeFi applications are open-source, so the code is commercially available and can be cloned for other projects. Imagine the lawsuits in any other niche.

Forks aren’t necessarily a bad thing either. In fact, forked projects can often have a higher TVL than their original applications. For example, on the DeFi forks tab Uniswap (the most forked software in DeFi) has been forked by services such as PancakeSwap (CAKE), SushiSwap (SUSHI), Curve Finance (CRV), SpookySwap (BOO) and has the highest TVL on DeFi Llama of $7.16b.

DeFi Airdrops

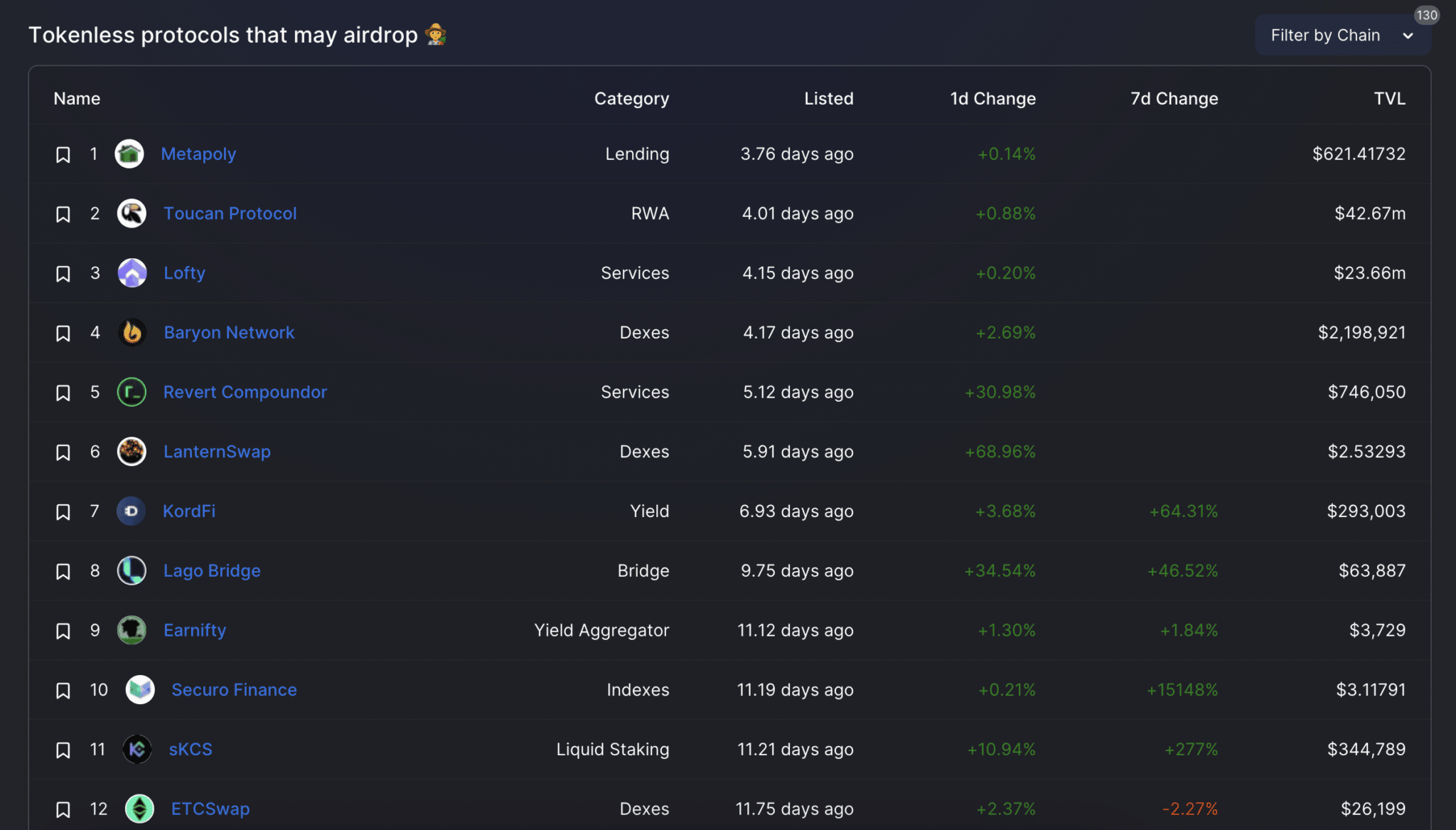

A DeFi airdrop is a token giveaway usually completed when a new cryptocurrency is launched to promote the token and build a community.

A popular airdrop was UniSwap, which dropped users upwards of $10,000 worth of UNI tokens when it launched. Another popular airdrop was by Ethereum Name Service (ENS), which sent upwards of $10,000 worth of tokens to users that registered .eth domain names.

Through the DeFi Llama Airdrops tab, users will find tokenless protocols that may airdrop soon. This allows users to get in early and optimize their earnings. TVL ranks each protocol, with the highest rated protocol being Arrakis Finance, with a TVL of $1.83b.

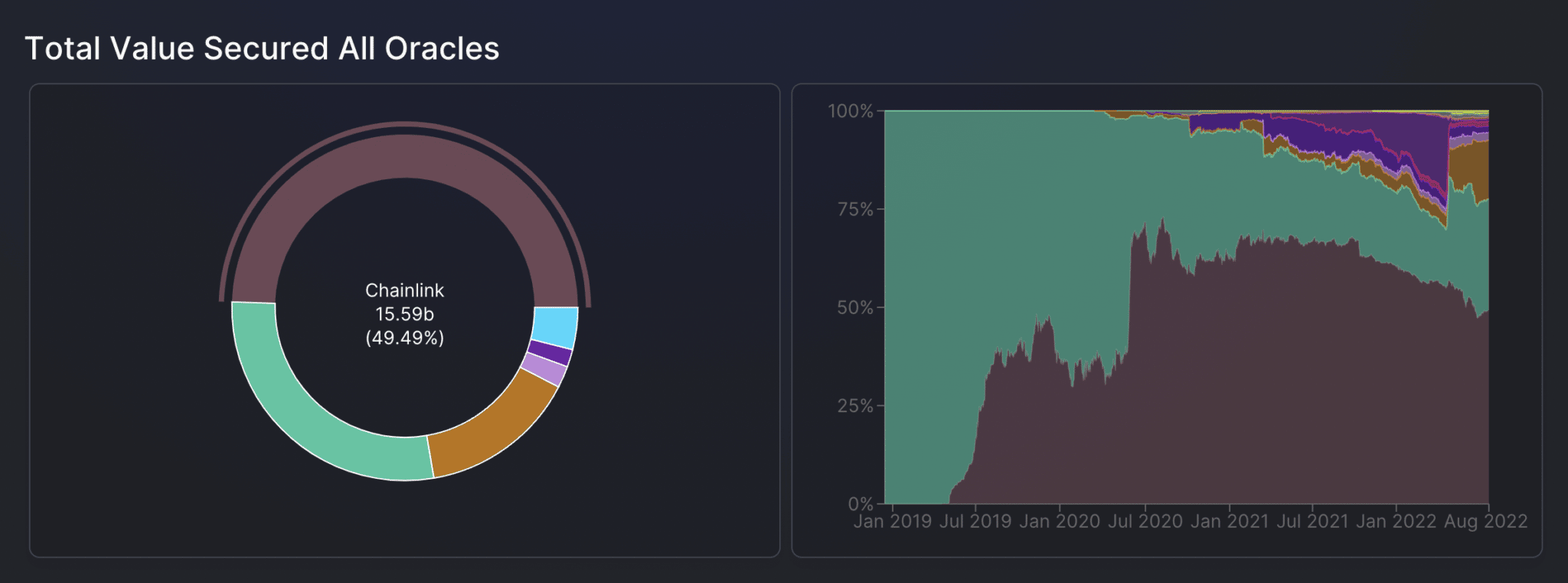

Oracles

Blockchain oracles help decentralized ecosystems communicate with the external world to validate data, improve security and prevent chains from being isolated through smart contracts. They send data such as payment service data, price feeds, and weather data.

Developers can also design automated systems without intermediaries that take data from the real world, though this process is similar to traditional finance.

Users can view the top oracle services in the market through the Oracles tab. As of July 2022, the top service is Chainlink (LINK), with a TVS of $15.94b and a market share of 50.94%. This is followed by services such as Maker (MKR) ($8.49b), WinkLink $4.55b, and Pthy ($639.97m.)

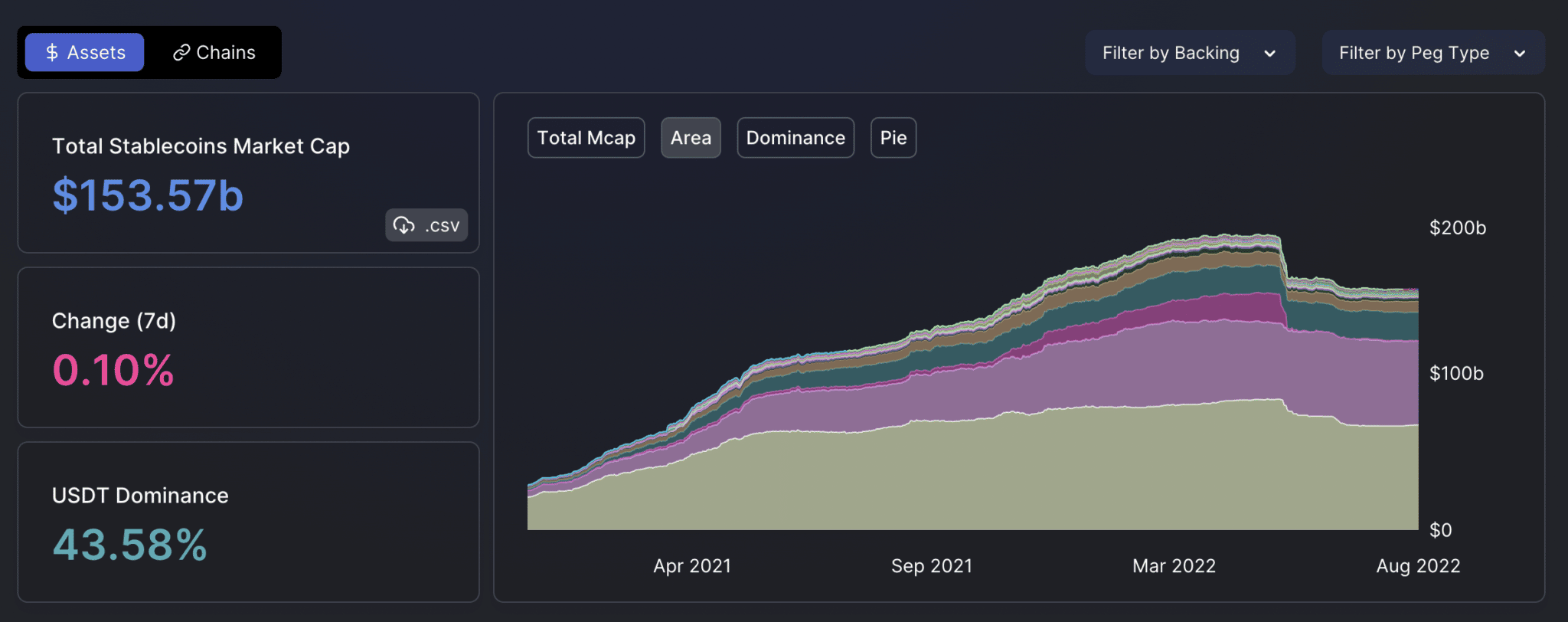

Stablecoins

Stablecoins is a new option for DeFi Llama. A stablecoin is an asset designed to have a relatively stable price, usually through being pegged to a commodity or currency or having its supply regulated by an algorithm.

Through the Stablecoins tab, users can view the market’s most popular stablecoins, ranked by market caps. The current industry leader is Tether (USDT), with a market cap of $66.39b, followed by USD Coin (USDC), with a market cap of $54.11b.

Are There Any DeFi Llama Alternatives?

DeFi Llama is a great data source for DeFi investors, but it also has many high-value competitors.

DeFi Llama’s competition also provides additional data for protocols like yield farms and toTVL data. These include:

- CoinMarketCap

- CoinGecko

- DappRader

- DeFi Pulse

- EtherScan.io

Despite being in the same niche, some of these sites have different specializations to DeFi Llama. For example, DappRader also looks at pricing data for NFT projects such as Axie Infinity and Bored Ape Yacht Club, which helps it stand out from other industry data sources.

Final Thoughts: Future Plans For DeFi Llama

Sites such as DeFi Llama allow you to make investment decisions based on actual data, not information promoted by a particular project, its fan base, or an influencer who’s been paid to promote a service. Although the price on exchanges may look good, it’s hard to determine price deviations (known as slippages) without all the data; even with the data, it can be a little tricky.

Slippage happens due to several reasons, including oracle manipulation, hacks, high levels of trading, or flash loan attacks when an individual takes out a large loan to lower the price of an asset on an exchange, which they then resell for a higher price.

Overall, the DeFi Llama API is a great source of information covering most of the DeFi market. It provides users with a clean, user-friendly interface where they can easily search for DeFi protocols based on their preferences.

However, it isn’t the only source of information out there. Competitors such as CoinMarketCap and CoinGecko provide very similar information, with sites like DappRader taking that one step further.

To get the best data that may fuel your decision-making, we’d advise using a combination of data sources from DeFi Llama and its competitors.

As the market continues to expand, the popularity of DeFi Llama is likely to grow with it, giving the project more opportunity to grow its reputation as a data provider in the DeFi industry.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.