- This Week in Cryptocurrency – Weekly News Recap

- What’s New at CoinCentral?

- More Cryptocurrency News From Around the Web

This Week in Cryptocurrency – Weekly News Recap

The Big Bitcoin 10k (and 11k): In case you missed it, Bitcoin broke into the 5-digit price club nearing $11,500.00 before taking a temporary dip. This momentous event was met with a combination of cheers from all over the cryptocurrency world and the sound of people slapping themselves in the head for not buying Bitcoin sooner.

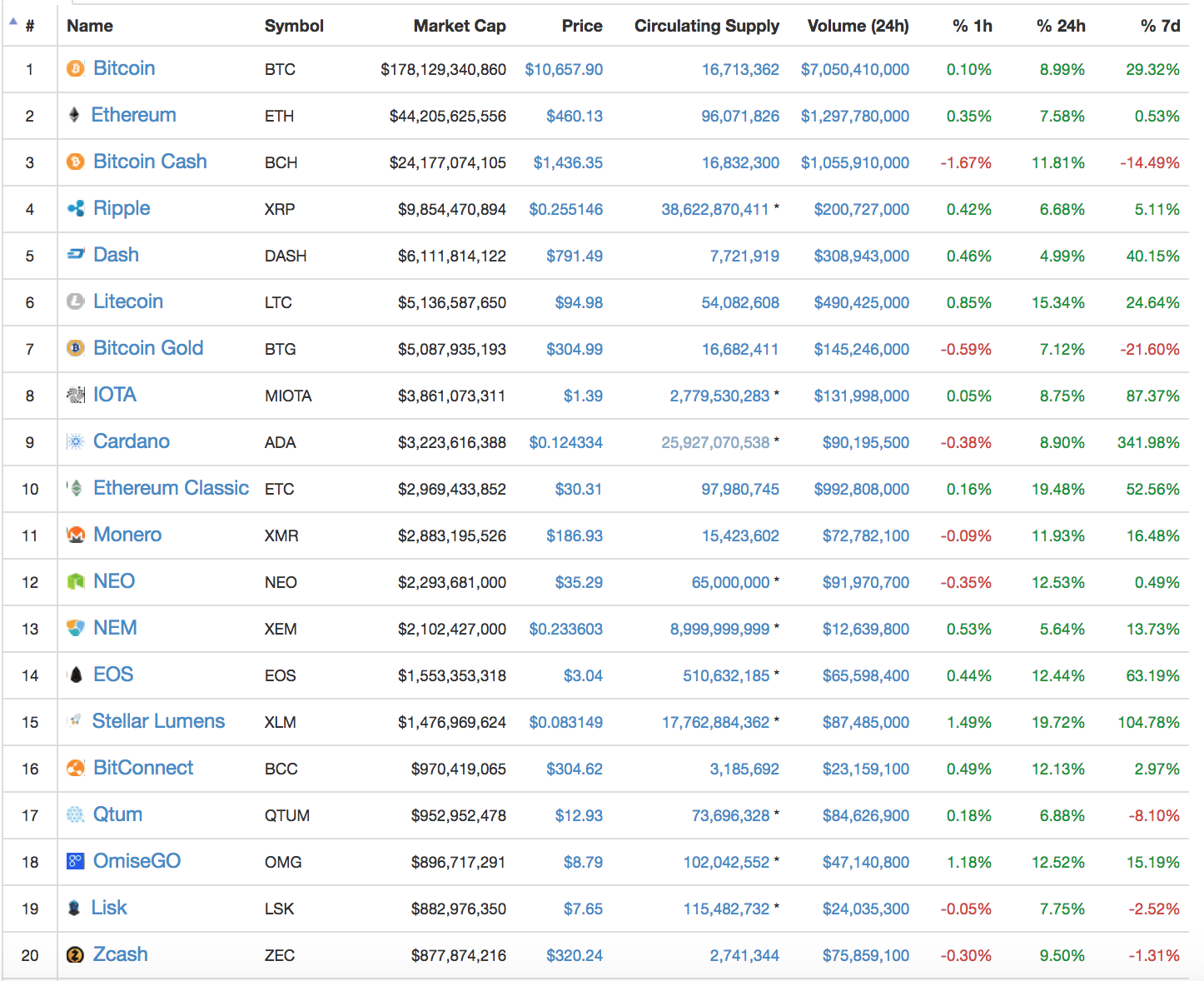

And you get an ATH, and you get an ATH: Not only did Bitcoin hit its new All-Time-High, a bunch of other coins hit their ATHs as well. Ethereum hit upwards of $520.00, Monero touched $212.00, Dash dashed to $826, and even Litecoin managed to break into the $100s nearing $104.00.

Trouble for Tether (continued): Last week, Tether claimed to be hacked for $$30,950,000 USDT. This week, people have been further questioning Tether’s legitimacy and voiced skepticism about their connection to Bitfinex. Many of these concerns focus on the rapid issuance of USDT, and question whether or not Tether actually has the assets to back up the new issuance. Charlie Lee, Litecoin’s founder, offered to look further into the issue.

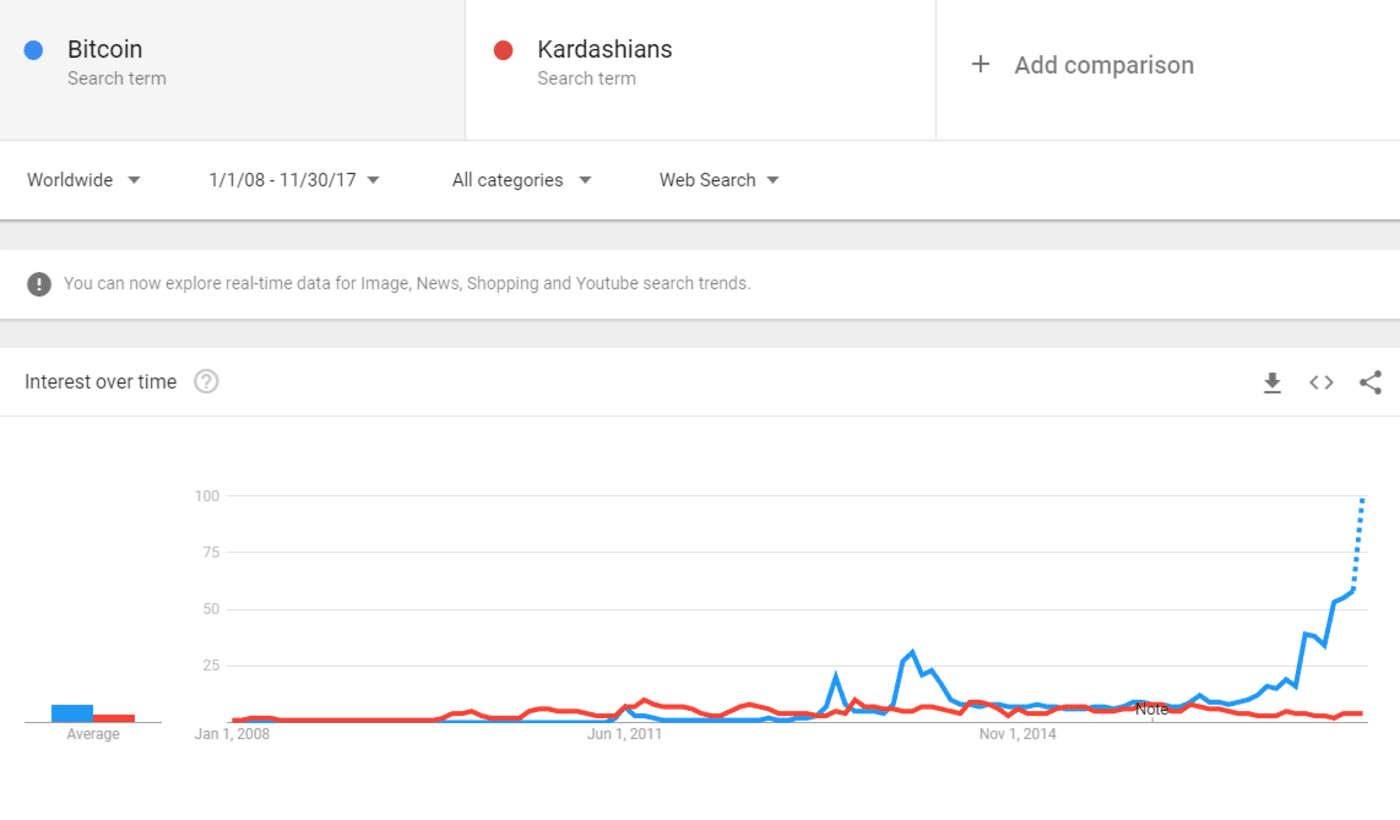

Keeping Up with The Cryptos: The spike in Bitcoin price helped rocket the number “bitcoin” search queries past that of “Kardashians”, essentially meaning more people are looking for Bitcoin information than Kardashians. This is notable for two reasons:

- Welcoming the early majority? This brings us to think about where Bitcoin’s popularity sites on the diffusion of innovation scale. The Kardashians are a household name, and Bitcoin likely will be soon enough, too.

- Media follows attention. This search volume isn’t something that’s going to go unnoticed by the media. We’ve seen larger media organizations like as Barstoolsports start putting out bitcoin-related content. While maybe not the best avenue to do so, this will help accelerate point #1.

The IRS and Coinbase – A love/hate relationship: A California federal court ordered Coinbase to report anyone who sold, sent, or received more than $20,000 through their Coinbase accounts in a single year between 2013 and 2015 to the IRS. Coinbase estimates that the 14,355 reported users met the government’s requirements.

Here’s two perspectives on the story:

- Crypto exchanges are inevitably going to clash with regulatory bodies. By cooperating with the IRS, Coinbase sets a precedent that will likely work in crypto’s favor in the long run.

- This set a bad precedent for financial privacy. Privacy is a huge selling point for many people in the crypto community, and they rightfully feel wronged by a government agency prying into their records.

- A caveat here. Even as someone who incredibly values his privacy, it’s important to understand the dark sides of financial privacy and why it could be a problem in the eyes of the government. It goes deeper than taxes. A huge issue arises when the bad-guys start using crypto to finance bad-guy things.

What’s New at CoinCentral?

This week, the CoinCentral team put together a bunch of new exciting resources:

New cryptocurrency guides made this week:

- What is Steem? – Learn about what this token tied to a revolutionary new content platform is all about.

- What is BAT? – A blockchain-based digital advertising token based on Ethereum.

- What is QTUM – A beginners’ guide on a blockchain technology that bridges Ethereum’s smart contracts on top of Bitcoin’s stable blockchain

- Review on the Rollercoaster – Insight into the wild ride of this week’s price jumps.

- Ethereum Faucets – Making Ethereum by watching ads, is it worth it?

[thrive_leads id=’3527′]

More Cryptocurrency News From Around the Web

Welcome to the Big Leagues, Kid: U.S. regulators gave permission to two of the world’s largest financial firms, CME Group Inc. and Cboe Global Markets Inc., to allow Bitcoin futures to trade. They plan to start listing these products on December 18th. CME will use a custom reference rate made with Crypto Facilities, and CBOE will use data from Gemini. This is big news, as being listed on these two exchanges opens the gates for a huge range of new investors.

Nasdaq + Bitcoin: The New York-based transatlantic exchange operator plans to launch a Bitcoin-based futures contract in 2018. This just marks yet another financial organization dipping its toes in the crypto water and tepidly embracing Bitcoin.

PWC + Bitcoin? One of the world’s largest accounting firms, PricewaterhouseCoopers (PWC), accepted bitcoin for its services for the first time ever in Hong Kong. The PwC Asia-Pacific chairman Raymund Chao noted: “It is also an indication that bitcoin and other established cryptocurrencies have now developed into more broadly accepted forms of settlement.” This makes PwC the second of the “Big Four” accounting firms to accept Bitcoin, as Ernst & Young (EY) beat them to the punch by accepting Bitcoin in Switzerland in late 2016.

Weekly Bitcoin Hater: This week’s Bitcoin hater award goes to Vanguard Founder Jack Bogle, who warned people to “AvoidBitcoin-Like the Plague.” While the “old guard vs. shiny new scary technology” isn’t anything new, it’s worth taking note of these things to see how opinions change in the coming months.

Satoshi Teslamoto? A rumor started circulating that Elon Musk is actually Bitcoin’s mysterious founder, Satoshi Nakamoto. A former SpaceX intern wrote a Medium post with some points that weren’t that bad.

- Deep understanding of economics and cryptography? Check.

- Master of C++ (the language Bitcoin was written in)? Check.

- Polymath? Check.

If true, we could add “Bitcoin creator” to this modern-day Ben Franklin’s resume that includes: SpaceX, Tesla, Solar City, and Hyperloop.

McAfee puts his money where is mouth is: Earlier this year, outspoken crypto-advocate and cyber security expert John McAfee stated that he would “eat his own dick on national TV” if Bitcoin’s price didn’t hit $500,000 by the year 2020. In light of Bitcoin hitting 10k this week, instead of breathing a sigh of relief and cruising, McAfee doubled down and upped his 2020 price target to $1,000,000 USD.

[thrive_leads id=’3527′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.